Alarm.com Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alarm.com Bundle

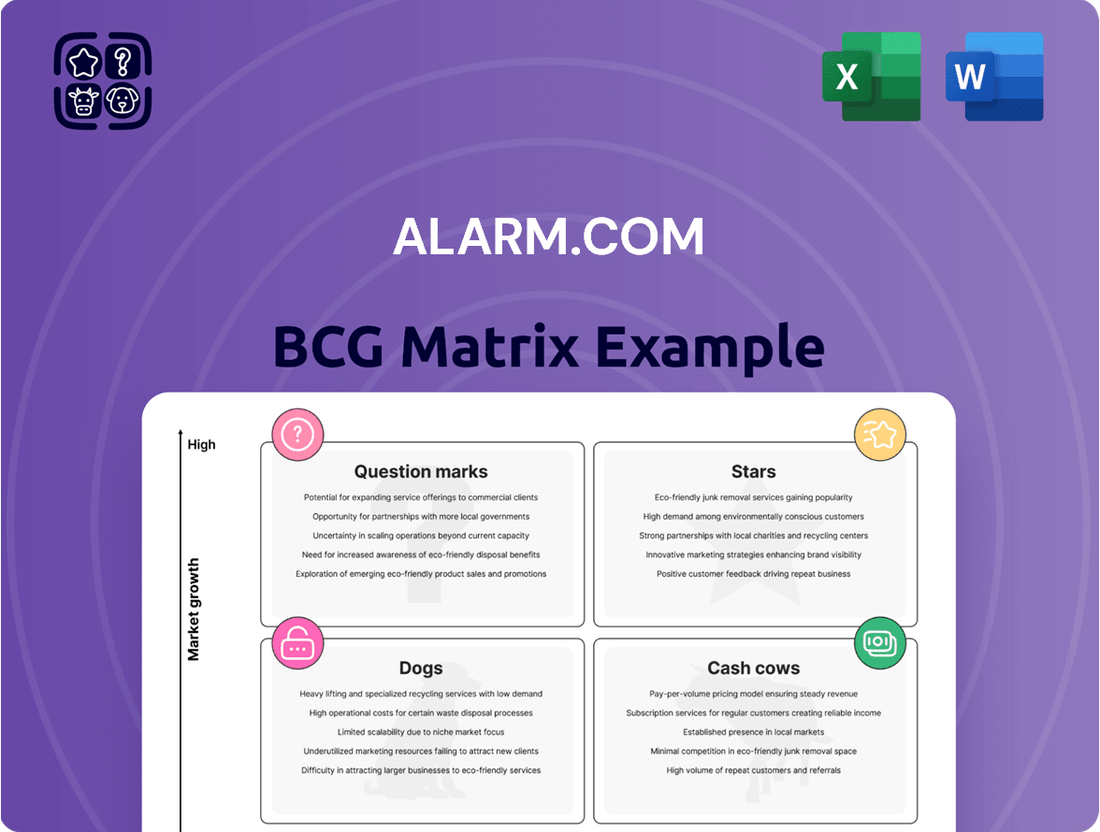

Curious about Alarm.com's product portfolio performance? This preview offers a glimpse into their position within the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. To truly unlock strategic advantages and make informed decisions about resource allocation and future investments, dive into the full BCG Matrix report.

Gain a comprehensive understanding of Alarm.com's market standing with our complete BCG Matrix analysis. This detailed report provides quadrant-by-quadrant insights, revealing which products are driving growth and which may require a strategic re-evaluation. Purchase the full version for actionable recommendations and a clear roadmap to optimize your business strategy.

Stars

Alarm.com's commercial security solutions, particularly those leveraging advanced analytics, are positioned as Stars in the BCG Matrix. The company's commercial segment is thriving, demonstrated by an impressive 98% revenue retention rate among commercial subscribers in Q1 2025. This strong performance is bolstered by the global commercial security system market's projected growth, fueled by rising security concerns and technological advancements like AI and IoT.

The continuous enhancement of Alarm.com's Business Activity Analytics (BAA) solution for commercial clients further solidifies its leadership in this dynamic sector. By enabling data-driven operational decisions, BAA empowers businesses to optimize their operations and security, making Alarm.com a key player in a market experiencing robust expansion.

Alarm.com is making significant strides in AI-powered video analytics, a key driver for its growth. Their AI Deterrence (AID) and Perimeter Solutions have garnered industry recognition, highlighting the company's commitment to innovative security. This focus on AI is clearly resonating with customers.

The 729 Floodlight video camera, a prime example of this AI integration, boasts an impressive 85% subscription rate. With nearly 4,000 new properties adopting this technology each month, it demonstrates a strong market demand for Alarm.com's proactive deterrence capabilities.

The overall video surveillance market is experiencing robust expansion, with AI integration identified as a critical growth factor. Alarm.com's early and substantial investment in AI-driven solutions positions them as a leader in this rapidly evolving landscape, poised to capture significant market share.

Alarm.com's Remote Video Monitoring (RVM) is positioned as a Star in its Business Growth Matrix. The acquisition of CHeKT in February 2025 significantly bolstered Alarm.com's RVM capabilities, integrating advanced video verification and proactive response features. This move directly addresses the surging market demand for sophisticated, real-time security solutions.

The RVM sector is experiencing robust growth, with industry analysts projecting continued expansion through 2025 and beyond, fueled by advancements in AI and cloud-based analytics. Alarm.com's strategic investment in RVM, particularly with the CHeKT integration, allows it to capture a larger share of this expanding market by offering superior, integrated video monitoring services for both homes and businesses.

EnergyHub and Smart Energy Management

EnergyHub, a key component of Alarm.com's strategy, is making substantial strides in the smart energy management space. In 2024, the company achieved a notable milestone by facilitating over 2,000 grid flexibility responses for its utility clients, setting a new record. This performance highlights EnergyHub's critical role in balancing energy demand and supply.

Further solidifying its market position, EnergyHub announced a significant partnership with General Motors Energy. This collaboration aims to seamlessly integrate GM electric vehicles into the EnergyHub platform, a move that taps into the rapidly growing electric vehicle and smart grid integration market. The integration is expected to leverage advanced AI for optimizing distributed energy resources.

- Record Grid Flexibility: EnergyHub responded to utility clients over 2,000 times in 2024, demonstrating robust grid management capabilities.

- Strategic EV Integration: A partnership with General Motors Energy will integrate GM EVs into the EnergyHub ecosystem, expanding its reach in the electric mobility sector.

- AI-Driven Optimization: The platform utilizes AI to optimize distributed energy resources, signaling strong potential in the expanding smart energy market.

Integrated Cloud-based Platform for Connected Property

Alarm.com's integrated cloud-based platform is a cornerstone of the intelligently connected property market. It seamlessly combines security, video, access control, and energy management into one cohesive system.

- Market Leadership: Alarm.com holds a dominant position in the connected property sector, driven by its innovative and scalable cloud platform.

- Revenue Growth: The company reported a 9% year-over-year increase in SaaS and license revenue in Q1 2025, reflecting strong customer adoption and platform utilization.

- Future Growth Driver: Continuous investment in research and development fuels the platform's evolution, positioning it for sustained growth in the expanding IoT landscape.

- Broad Integration: The platform's ability to integrate diverse property management functions creates significant value for both service providers and end-users.

Alarm.com's commercial security solutions, particularly those leveraging advanced analytics, are positioned as Stars in the BCG Matrix. The company's commercial segment is thriving, demonstrated by an impressive 98% revenue retention rate among commercial subscribers in Q1 2025. This strong performance is bolstered by the global commercial security system market's projected growth, fueled by rising security concerns and technological advancements like AI and IoT.

The continuous enhancement of Alarm.com's Business Activity Analytics (BAA) solution for commercial clients further solidifies its leadership in this dynamic sector. By enabling data-driven operational decisions, BAA empowers businesses to optimize their operations and security, making Alarm.com a key player in a market experiencing robust expansion.

Alarm.com is making significant strides in AI-powered video analytics, a key driver for its growth. Their AI Deterrence (AID) and Perimeter Solutions have garnered industry recognition, highlighting the company's commitment to innovative security. This focus on AI is clearly resonating with customers.

The 729 Floodlight video camera, a prime example of this AI integration, boasts an impressive 85% subscription rate. With nearly 4,000 new properties adopting this technology each month, it demonstrates a strong market demand for Alarm.com's proactive deterrence capabilities.

The overall video surveillance market is experiencing robust expansion, with AI integration identified as a critical growth factor. Alarm.com's early and substantial investment in AI-driven solutions positions them as a leader in this rapidly evolving landscape, poised to capture significant market share.

Alarm.com's Remote Video Monitoring (RVM) is positioned as a Star in its Business Growth Matrix. The acquisition of CHeKT in February 2025 significantly bolstered Alarm.com's RVM capabilities, integrating advanced video verification and proactive response features. This move directly addresses the surging market demand for sophisticated, real-time security solutions.

The RVM sector is experiencing robust growth, with industry analysts projecting continued expansion through 2025 and beyond, fueled by advancements in AI and cloud-based analytics. Alarm.com's strategic investment in RVM, particularly with the CHeKT integration, allows it to capture a larger share of this expanding market by offering superior, integrated video monitoring services for both homes and businesses.

EnergyHub, a key component of Alarm.com's strategy, is making substantial strides in the smart energy management space. In 2024, the company achieved a notable milestone by facilitating over 2,000 grid flexibility responses for its utility clients, setting a new record. This performance highlights EnergyHub's critical role in balancing energy demand and supply.

Further solidifying its market position, EnergyHub announced a significant partnership with General Motors Energy. This collaboration aims to seamlessly integrate GM electric vehicles into the EnergyHub platform, a move that taps into the rapidly growing electric vehicle and smart grid integration market. The integration is expected to leverage advanced AI for optimizing distributed energy resources.

- Record Grid Flexibility: EnergyHub responded to utility clients over 2,000 times in 2024, demonstrating robust grid management capabilities.

- Strategic EV Integration: A partnership with General Motors Energy will integrate GM EVs into the EnergyHub ecosystem, expanding its reach in the electric mobility sector.

- AI-Driven Optimization: The platform utilizes AI to optimize distributed energy resources, signaling strong potential in the expanding smart energy market.

Alarm.com's integrated cloud-based platform is a cornerstone of the intelligently connected property market. It seamlessly combines security, video, access control, and energy management into one cohesive system.

- Market Leadership: Alarm.com holds a dominant position in the connected property sector, driven by its innovative and scalable cloud platform.

- Revenue Growth: The company reported a 9% year-over-year increase in SaaS and license revenue in Q1 2025, reflecting strong customer adoption and platform utilization.

- Future Growth Driver: Continuous investment in research and development fuels the platform's evolution, positioning it for sustained growth in the expanding IoT landscape.

- Broad Integration: The platform's ability to integrate diverse property management functions creates significant value for both service providers and end-users.

Alarm.com's commercial security solutions, particularly those leveraging advanced analytics, are positioned as Stars in the BCG Matrix due to their high market share and strong growth prospects. The company's commercial segment is thriving, demonstrated by an impressive 98% revenue retention rate among commercial subscribers in Q1 2025. This robust performance, combined with the global commercial security system market's projected growth, solidifies these offerings as key growth drivers.

What is included in the product

The Alarm.com BCG Matrix analyzes its product portfolio to guide investment decisions.

It categorizes offerings into Stars, Cash Cows, Question Marks, and Dogs to inform strategic resource allocation.

The Alarm.com BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain point of complex portfolio analysis.

Cash Cows

Alarm.com's core strength lies in its recurring SaaS and license revenue from its extensive residential customer base. This segment is the company's cash cow, consistently delivering high gross margins, with SaaS revenue margins surpassing 85%.

The residential segment benefits from a remarkable 94% customer renewal rate, underscoring the sticky nature of its service. Even with slower growth in the North American residential market, influenced by factors like higher interest rates in 2024, this segment remains a vital source of predictable and stable cash flow.

Alarm.com's professional service provider network acts as a significant Cash Cow within its business model. This extensive network of thousands of installers and managers worldwide allows Alarm.com to efficiently reach a broad customer base. In 2024, this B2B2C approach continued to be a bedrock of their revenue generation, as these partners are crucial for the deployment and ongoing support of Alarm.com's smart home and security solutions.

The strength of this network lies in its scalability and cost-effectiveness. By relying on these established service providers, Alarm.com minimizes its direct operational costs associated with customer acquisition and installation. This model generates predictable revenue streams, a hallmark of a Cash Cow, as the partners are incentivized to maintain and expand the use of Alarm.com's platform.

Furthermore, the deep integration and ongoing professional support provided by these partners create substantial switching costs for end-users. This customer loyalty translates into a stable and recurring revenue base for Alarm.com, solidifying the Cash Cow status of its service provider network. The consistent revenue from this segment helps fund investments in other areas of the business.

Alarm.com's established interactive security and automation services are the bedrock of its business, functioning as true cash cows. These foundational offerings, encompassing remote monitoring, arming/disarming, and essential home automation, have achieved widespread adoption in both residential and commercial sectors. This maturity translates into a substantial and loyal installed base, consistently generating high-margin, predictable revenue streams.

The reliability of these services means Alarm.com can significantly reduce its investment in new promotions, allowing the company to capture consistent cash flow. For instance, in 2023, Alarm.com reported strong recurring revenue growth, largely driven by its established service packages, underscoring their dependable cash-generating capabilities. This steady income fuels further innovation and supports other areas of the company's portfolio.

Core Video Monitoring Solutions (Non-AI Advanced)

Alarm.com's core video monitoring solutions, offering features like live view, 24/7 recording, and basic motion detection, are firmly positioned as Cash Cows within its BCG Matrix. These services boast high market penetration among Alarm.com's extensive subscriber base, acting as a significant and stable contributor to the company's recurring revenue. While not experiencing rapid growth, their established presence and widespread adoption ensure consistent cash generation.

These foundational video services are crucial for maintaining Alarm.com's existing customer relationships and provide a reliable income stream. Their maturity in the market means lower investment needs, allowing the cash generated to be redirected to more promising areas, such as their AI-powered video solutions which are classified as Stars.

- High Market Share: Core video monitoring is a staple for a significant portion of Alarm.com's user base.

- Stable Revenue Generation: These services provide a predictable and consistent cash flow.

- Low Growth, High Profitability: While not expanding rapidly, they are highly profitable due to established infrastructure and adoption.

- Resource Allocation: Cash generated here helps fund growth initiatives in other product categories.

Access Control Solutions for Existing Commercial Clients

Alarm.com's access control solutions for existing commercial clients are a prime example of a Cash Cow within its BCG Matrix. These offerings are well-established and generate consistent, predictable revenue streams from a loyal customer base. The high customer retention rate of 98% in the commercial sector underscores the enduring value and reliability of these integrated systems.

These solutions provide a steady income for Alarm.com, as businesses depend on them for ongoing security and operational efficiency. The mature nature of these products means they require less investment for maintenance and growth, allowing them to generate significant cash flow. This consistent performance is crucial for funding other areas of the business.

- Mature Offering: Alarm.com's access control is a stable, integrated part of its platform for existing commercial clients.

- Consistent Revenue: These systems deliver reliable recurring revenue from businesses needing managed access.

- High Retention: A 98% revenue retention rate in the commercial segment highlights the stickiness and cash-generating power of these established solutions.

Alarm.com's established interactive security and automation services are its core cash cows, generating substantial and predictable revenue. These mature offerings have high market penetration and require minimal new investment, allowing them to consistently produce strong cash flow. For example, in 2023, Alarm.com's recurring revenue, largely driven by these services, saw robust growth, highlighting their dependable cash-generating capabilities.

The company's video monitoring solutions also function as cash cows. With high adoption rates among its user base, these services provide stable, recurring income with low growth but high profitability due to established infrastructure. This consistent cash generation fuels investment in more innovative areas.

Alarm.com's access control solutions for commercial clients are another key cash cow. These well-established systems benefit from a 98% revenue retention rate in the commercial sector, signifying their reliability and the consistent, predictable cash flow they generate. This steady income is vital for supporting the company's broader strategic initiatives.

| Segment | BCG Category | Key Characteristics | 2023 Financial Insight |

| Residential SaaS & Licenses | Cash Cow | High gross margins (>85%), 94% customer renewal rate | Stable, predictable revenue despite slower market growth |

| Professional Service Provider Network | Cash Cow | Scalable, cost-effective B2B2C model, high switching costs | Bedrock of revenue generation and customer reach |

| Interactive Security & Automation | Cash Cow | Widespread adoption, loyal installed base, low promotional investment | Strong recurring revenue growth driver |

| Core Video Monitoring | Cash Cow | High market penetration, stable income, low growth/high profitability | Consistent cash flow, funds growth initiatives |

| Commercial Access Control | Cash Cow | Mature offering, reliable recurring revenue, high retention (98%) | Steady income, crucial for funding other business areas |

Preview = Final Product

Alarm.com BCG Matrix

The Alarm.com BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase, ensuring complete transparency and no hidden surprises.

This comprehensive BCG Matrix analysis for Alarm.com is exactly what you will download, providing you with actionable insights and strategic clarity without any watermarks or demo content.

Rest assured, the document you are previewing is the final, professional-grade Alarm.com BCG Matrix report, ready for immediate use in your business planning and strategic decision-making.

What you see is the actual, analysis-ready Alarm.com BCG Matrix file that will be yours upon purchase, offering a direct and unedited view of the strategic landscape.

Dogs

Alarm.com's hardware sales are a classic example of a commoditized business within their portfolio. In fiscal year 2024, this segment saw flat revenue, highlighting its mature and less dynamic nature compared to their software offerings. While essential for supporting the core SaaS platform, the hardware component operates on lower margins, making it less of a growth engine.

The segment faces considerable headwinds. U.S. tariff policies pose a direct risk to cost structures and pricing, potentially squeezing already thin margins. Furthermore, the increasing availability of low-cost video products, especially from Asian manufacturers, intensifies price competition. This competitive pressure, coupled with the inherent low growth of commoditized hardware, particularly for non-differentiated or older models, positions it as a potential cash trap.

Legacy or Outdated Product Support within Alarm.com's portfolio likely falls into the 'dog' category of the BCG matrix. These are older security devices or software features that Alarm.com still supports for a shrinking customer base but no longer actively invests in for new development or promotion. For instance, while exact figures for Alarm.com's legacy product support aren't publicly detailed, many technology companies in the connected home space dedicate resources to maintaining older systems, which can divert funds from more innovative growth areas.

Alarm.com's core strength lies in its professional installer network, a stark contrast to the DIY market. If Alarm.com were to enter the DIY space, it would face intense competition from established players like Google Nest and Amazon Ring, which dominate with aggressive pricing and a substantial market presence.

The DIY residential market is characterized by low margins and high volume, a segment where Alarm.com's premium, service-oriented model might not translate effectively. For instance, the global smart home market, including DIY components, was projected to reach over $150 billion in 2024, a significant portion of which is driven by these lower-cost alternatives.

Attempting to compete directly in this low-end DIY segment could necessitate substantial investment for potentially minimal market share gains. This could divert resources from Alarm.com's core business, which thrives on providing integrated, high-value solutions through professional installation and ongoing service.

Underperforming International Geographic Segments

Alarm.com's international segments, while a strategic focus, may represent 'dogs' if they exhibit weak market penetration or a limited service provider network. These areas could be demanding significant investment in market development and localization without yielding substantial returns. For instance, if a particular European market shows low adoption rates for smart home security despite Alarm.com's efforts, it might fall into this category.

Such underperforming geographic segments would likely be characterized by a low market share and slow growth, requiring substantial resources to improve. This scenario would mean that capital allocated to these regions isn't generating the expected profitability or competitive advantage.

- Underperforming International Markets: Specific regions where Alarm.com faces challenges in establishing a strong presence or achieving significant market share.

- Resource Drain: These segments may consume valuable company resources for market development and localization without delivering commensurate growth or profitability.

- Low Market Share and Growth: Indicators of a 'dog' segment include a small existing customer base and minimal year-over-year revenue increases in these international territories.

Niche Integrations with Declining Platforms

Niche integrations with declining platforms represent a 'dog' category for Alarm.com within the BCG Matrix. These could include partnerships with smart home devices or software that are losing market traction or becoming obsolete in the rapidly evolving Internet of Things (IoT) landscape.

Continuing to support and update these integrations might drain valuable development resources, yielding minimal returns due to their limited market share and growth prospects. For instance, if Alarm.com maintains integration with a specific legacy smart lock brand that saw peak adoption in 2018 and now accounts for less than 0.5% of new smart home installations, this would be a prime example of a dog asset.

- Declining Market Share: Integrations with smart home ecosystems that have seen significant user attrition, potentially below a 1% decline year-over-year in active users.

- Resource Drain: Development and maintenance costs for these niche integrations outweigh the revenue or strategic value they generate.

- Obsolete Technology: Support for protocols or hardware that are no longer industry standard, hindering broader adoption or compatibility.

Alarm.com's commoditized hardware, like older security devices or software features, can be considered 'dogs' in the BCG matrix. These segments, while still supported, offer low growth and margins, potentially consuming resources without significant returns. For example, maintaining integrations with declining smart home platforms or underperforming international markets that struggle with adoption rates exemplify these 'dog' assets.

These 'dog' segments are characterized by low market share and slow growth, demanding substantial resources for improvement without generating expected profitability or competitive advantage. The increasing availability of low-cost video products, for instance, intensifies price competition for Alarm.com's hardware, squeezing already thin margins.

Such underperforming areas might include specific international markets where Alarm.com faces challenges in establishing a strong presence, or niche integrations with platforms losing market traction. These segments often consume valuable development resources, yielding minimal returns due to their limited market share and growth prospects.

For instance, if Alarm.com maintains integration with a specific legacy smart lock brand that saw peak adoption in 2018 and now accounts for less than 0.5% of new smart home installations, this would be a prime example of a dog asset.

Question Marks

Alarm.com's ADC-T25 Smart Thermostat, launched in July 2025, represents a strategic move into the expanding smart home energy management market. This new product is positioned to capitalize on the increasing consumer demand for advanced HVAC controls and energy efficiency solutions. The smart thermostat market is projected to reach $10.5 billion globally by 2027, growing at a CAGR of 17.2%, according to recent industry reports.

As a recent entrant, the ADC-T25 likely holds a nascent market share, placing it in the question mark category of the BCG matrix. This means it operates in a high-growth industry but requires substantial investment to gain traction and compete effectively against established players. For instance, competitors like Nest and Ecobee have already secured significant market penetration through years of product development and marketing efforts.

Alarm.com's introduction of advanced deterrence technologies like the Sunflower Labs drone and VizBlinder at ISC West 2024 positions them as potential Stars in the BCG matrix. These innovations offer proactive security, a rapidly growing market segment.

The autonomous drone and haze-generating VizBlinder are cutting-edge, suggesting high future growth potential. However, as new offerings, their current market share is likely low, requiring significant investment to develop and capture market share, characteristic of a Question Mark.

The EPX500 Fire Communicator, launched by Alarm.com in March 2025, represents a strategic entry into the commercial fire safety market. This product aims to integrate seamlessly with fire alarm systems, addressing a growing segment within the broader commercial security landscape. While the overall commercial security market shows promise, Alarm.com's presence in the niche of fire communicators is likely in its early stages, suggesting a nascent market share.

This new product launch positions the EPX500 as a potential 'Question Mark' within Alarm.com's Boston Consulting Group (BCG) Matrix. The commercial fire alarm connectivity sector is expanding, but requires substantial investment to build brand recognition and secure a competitive foothold. The success of the EPX500 will depend on its ability to capture market share against established players in this specialized field.

International Expansion into Specific New Regions

Alarm.com's strategic focus on international expansion places new regions with limited existing presence into the question mark category of the BCG matrix. With the vast majority of its revenue, around 94%, currently generated within the United States, these emerging markets represent significant opportunities for growth in connected property solutions.

These international markets are characterized by high growth potential, but also necessitate substantial investment from Alarm.com. This investment is crucial for establishing a foothold, building brand awareness, and tailoring its product and service offerings to meet the unique demands of each local market.

- High Growth Potential: Emerging international markets offer substantial upside for Alarm.com's connected property solutions.

- Limited Existing Presence: Alarm.com currently has a minimal footprint in these new regions.

- Investment Required: Significant capital will be needed to build market share and adapt offerings.

- Strategic Importance: International expansion is a key growth strategy to diversify revenue streams beyond the US.

Cell Connector for Video

Alarm.com's Cell Connector for Video, recognized with a 2025 ESX Innovation Award in June 2025, signifies a notable advancement in their video surveillance offerings. This award underscores the product's innovative design and its potential to disrupt the video market.

The Cell Connector for Video is positioned within the high-growth video segment, indicating strong market potential. Its recent introduction suggests it currently holds a low market share, necessitating significant investment for expansion and market penetration.

- Product Innovation: Awarded a 2025 ESX Innovation Award, signaling strong technological merit.

- Market Segment: Operates in the high-growth video surveillance sector.

- Market Share: Likely possesses a low current market share due to its recent introduction.

- Investment Needs: Requires substantial investment to achieve widespread adoption and market leadership.

Alarm.com's ADC-T25 Smart Thermostat, launched in July 2025, operates in the high-growth smart home energy management market, projected to reach $10.5 billion globally by 2027. As a recent entrant, it likely holds a nascent market share, requiring significant investment to compete with established players like Nest and Ecobee, thus classifying it as a Question Mark.

The Cell Connector for Video, recognized with a 2025 ESX Innovation Award, targets the high-growth video surveillance sector. Its recent introduction means a low current market share, necessitating substantial investment for market penetration and adoption, placing it firmly in the Question Mark category.

Alarm.com's strategic international expansion efforts, with revenue currently 94% from the US, place these new regions as Question Marks. These markets offer high growth potential but demand significant investment to build brand awareness and tailor offerings, crucial for diversifying revenue streams.

The EPX500 Fire Communicator, launched in March 2025, enters the expanding commercial fire safety market. Its early stage in this niche suggests a low market share, requiring substantial investment to build recognition and gain a competitive foothold against established brands, positioning it as a Question Mark.

| Product/Initiative | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| ADC-T25 Smart Thermostat | Question Mark | High | Low (Nascent) | High |

| Cell Connector for Video | Question Mark | High | Low (Recent) | High |

| International Expansion | Question Mark | High | Low (Minimal) | High |

| EPX500 Fire Communicator | Question Mark | High (Expanding) | Low (Early Stage) | High |

BCG Matrix Data Sources

Our Alarm.com BCG Matrix is built on a foundation of comprehensive market data, including company financial reports, industry growth projections, and competitive landscape analysis.