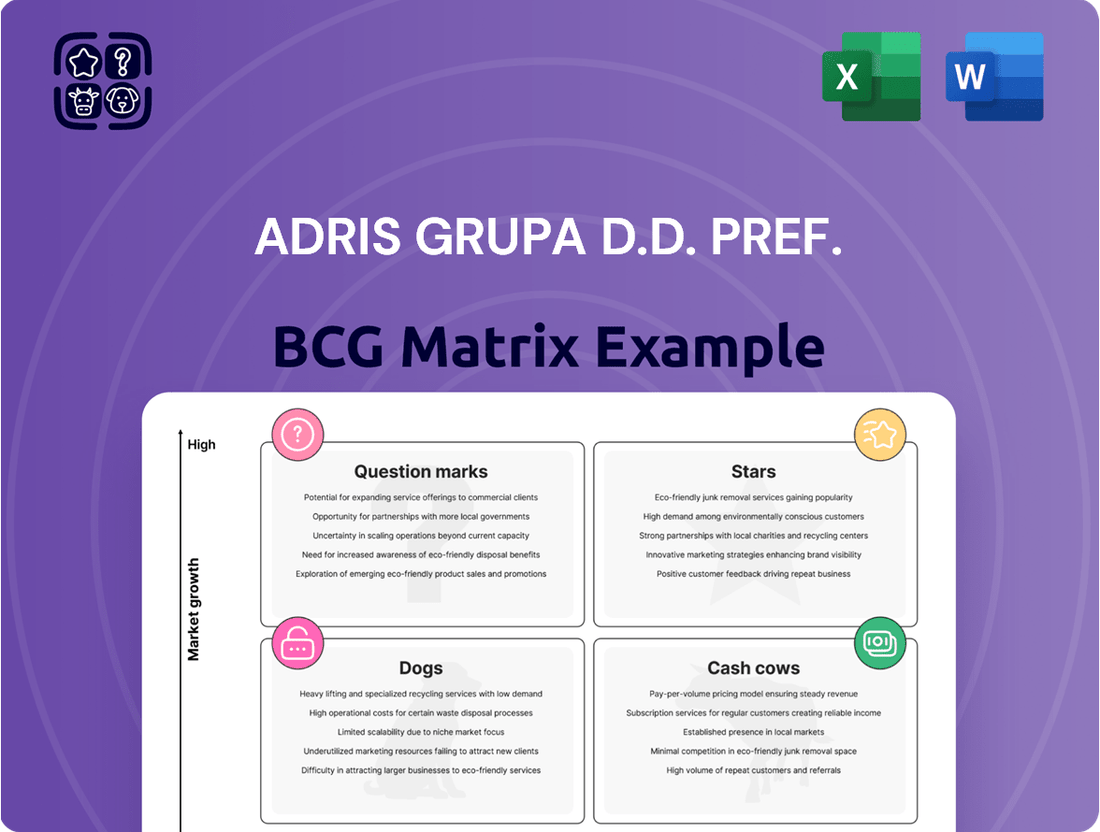

Adris grupa d.d. Pref. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adris grupa d.d. Pref. Bundle

Uncover the strategic positioning of Adris grupa d.d.'s diverse portfolio with our insightful BCG Matrix preview. See where their offerings might be shining as Stars, comfortably generating Cash Cows, lagging as Dogs, or presenting exciting opportunities as Question Marks. This glimpse is just the beginning of understanding their market dynamics.

Ready to transform this insight into action? Purchase the full BCG Matrix report to gain a comprehensive, quadrant-by-quadrant analysis, complete with data-backed recommendations and a clear roadmap for optimizing Adris grupa's investments and product strategies. Don't miss out on the clarity you need to make impactful decisions.

Stars

Adris grupa is significantly enhancing its tourism assets, with a strong emphasis on the luxury and premium sectors. Projects like the new Marjan Hotel in Split and premium campsites in Istria exemplify this commitment. These strategic upgrades are designed to attract a higher-spending clientele and capitalize on the robust growth anticipated in Croatia's tourism sector.

With over EUR 400 million earmarked for tourism investments between 2024 and 2026, Adris is clearly positioning its luxury tourism development as a star performer. Croatia's tourism saw a notable surge in arrivals and overnight stays in 2024, with projections indicating sustained growth through 2025. This focus on high-quality experiences is expected to drive substantial revenue increases for these ventures.

Adris grupa is making a significant push into green energy, a move that positions it as a Star in the BCG matrix. The company allocated EUR 87 million in 2024 for these initiatives and plans to invest over EUR 130 million between 2024 and 2026.

This strategic diversification includes the near completion of six power plants, a testament to their commitment to this high-growth sector. The substantial capital deployment underscores the expectation of strong future returns and market share capture in renewable energy.

Croatia Osiguranje's digital brand, LAQO, is a shining example of a Star in the Adris grupa d.d. BCG Matrix. It experienced impressive premium growth of 34% in the first nine months of 2024, and further solidified this by achieving 29% growth for the entire year 2024.

This substantial expansion in the digital insurance sector highlights LAQO's strong market position and Adris's successful digitalization strategy. The company is effectively tapping into the growing demand for online insurance services, positioning LAQO for continued dominance and market share gains.

Expansion of Private Healthcare Services

Adris grupa's expansion of private healthcare services, primarily through Croatia Osiguranje, is a clear indicator of a Star in their portfolio. The company is strategically acquiring key players, such as polyclinics Marin Med in Dubrovnik and Medros in Osijek during 2024. This aggressive market consolidation directly contributed to a remarkable 54% revenue growth within this specific segment.

The focus on private healthcare aligns with increasing consumer demand and represents a high-growth niche. By investing heavily and consolidating market share, Adris grupa is positioning these services for continued profitability and expansion. This strategic move aims to capture a larger portion of a rapidly developing market.

- Strategic Acquisitions: Polyclinics Marin Med and Medros acquired in 2024.

- Revenue Growth: 54% revenue increase in the private healthcare segment.

- Market Position: Targeting increased market share in a high-demand sector.

- Growth Potential: Identified as a Star due to strong growth and market attractiveness.

High-Growth International Tourism Markets

While Croatia's tourism sector is experiencing a general uplift, Adris group is strategically focusing on high-spending international markets. For instance, there's been a notable increase in American tourists visiting Croatia. This aligns with the broader global tourism recovery, which is projected to see continued growth into 2025.

Adris's investment in premium offerings and targeted marketing aims to capitalize on this trend. By attracting discerning travelers, they are positioning themselves to benefit from the increased demand in these lucrative source markets.

- Targeted Market Growth: U.S. traveler numbers to Croatia have shown a positive trajectory.

- Global Tourism Recovery: The international tourism sector is on an upward trend, with strong growth anticipated for 2025.

- Premium Offering Focus: Adris is enhancing quality and marketing to attract high-spending international visitors.

- Strategic Investment: Resources are being allocated to capture demand from these high-potential markets.

The luxury tourism segment, exemplified by projects like the Marjan Hotel in Split and premium campsites, is a clear Star for Adris grupa. With over EUR 400 million invested between 2024 and 2026, and Croatia's tourism showing robust growth in 2024, these ventures are poised for significant revenue increases by attracting high-spending international tourists, including a notable rise in American visitors.

| Segment | Investment (2024-2026) | 2024 Growth Indicator | Market Trend | BCG Status |

|---|---|---|---|---|

| Luxury Tourism | > EUR 400 million | Increased arrivals, focus on premium offerings | Strong global recovery, U.S. visitor growth | Star |

| Green Energy | > EUR 130 million | EUR 87 million invested in 2024 | High-growth sector | Star |

| Digital Insurance (LAQO) | N/A (focus on growth) | 34% premium growth (9M 2024), 29% (FY 2024) | Growing demand for online services | Star |

| Private Healthcare | N/A (focus on acquisitions) | 54% revenue growth (2024) | Increasing consumer demand, market consolidation | Star |

What is included in the product

This BCG Matrix analysis provides a tailored view of Adris grupa's portfolio, identifying strategic opportunities.

Simplified BCG Matrix for Adris grupa d.d. to quickly identify and address underperforming business units.

Cash Cows

Adris grupa's coastal tourism operations, encompassing a wide array of hotels, resorts, and campsites, hold a dominant position in Croatia's tourism landscape. These established assets are mature but continue to be significant revenue drivers for the company.

In 2024, the tourism segment of Adris grupa reported impressive sales revenue of EUR 326 million, underscoring the consistent cash-generating capacity of these well-positioned coastal properties. While these businesses benefit from ongoing quality enhancements, their primary role is to provide substantial and reliable cash flow.

Adris's core insurance business, primarily through Croatia Osiguranje, is a significant cash cow. Despite operating in a mature Croatian insurance market, which is projected to grow at a modest 3.6% CAGR from 2025 to 2035, the company's strong market position ensures consistent performance.

In 2024, this segment delivered consolidated insurance sales revenue of EUR 541 million, underscoring its substantial contribution to Adris Group's overall financial health. The generated net profit from these operations provides a stable and dependable source of cash flow, forming the bedrock of the group's financial stability.

Cromaris, Adris's aquaculture division, is a prime example of a cash cow within the group's portfolio. In 2024, it generated EUR 108 million in sales revenue, demonstrating significant market penetration with 86% of its sales volume and 85% of its revenue originating from international markets.

This strong international focus, coupled with a 10% increase in net profit in 2024, highlights Cromaris's consistent profitability and its role as a stable income generator for Adris. Its established position in the healthy food sector, particularly in aquaculture, solidifies its status as a dependable cash cow.

Stable Dividend Payouts

Adris grupa d.d. consistently demonstrates its commitment to shareholder returns through stable dividend payouts. For 2024, the company proposed a dividend of EUR 3.00 per share, scheduled for payment in July 2025. This reflects the robust cash-generating capabilities of its mature business segments.

The Group's financial health, characterized by low indebtedness and solid business performance, underpins its ability to sustain these dividend payments. This consistent return signifies a healthy core business that reliably generates excess cash.

- Proposed Dividend: EUR 3.00 per share (payable July 2025).

- Financial Stability: Low indebtedness and strong business results support payouts.

- Cash Flow Generation: Mature, high-market-share businesses are the source of consistent cash.

- Shareholder Returns: Demonstrates commitment to rewarding investors.

Overall Consolidated Profitability and Financial Stability

Adris grupa d.d. demonstrated robust overall financial health in 2024, a key indicator for its Cash Cow status. The company achieved a consolidated revenue of EUR 1.1 billion, marking an 11% increase, and reported a net profit of EUR 87 million, up 6%. This strong performance highlights its consistent ability to generate substantial cash flow.

The Group's financial stability is further underscored by its consolidated debt, which stands at 1.3 times EBITDA. This ratio signifies a healthy balance, indicating Adris grupa's strong capacity to service its debt while simultaneously generating ample cash for reinvestment and maintaining a solid financial footing.

- Strong Revenue Growth: Consolidated revenue reached EUR 1.1 billion in 2024, an 11% increase.

- Healthy Net Profit: Reported net profit was EUR 87 million, a 6% rise.

- Financial Stability: Consolidated debt at 1.3 times EBITDA indicates a robust financial position.

- Cash Generation Capacity: The company's performance suggests a significant ability to generate cash for investments and operations.

Adris grupa's insurance segment, led by Croatia Osiguranje, is a cornerstone cash cow. In 2024, it generated EUR 541 million in sales revenue, showcasing its consistent profitability in a mature market. This segment's strong market share ensures a stable and dependable cash flow, forming the financial bedrock of the group.

The company's tourism operations also function as a significant cash cow, with EUR 326 million in sales revenue reported for 2024. These established coastal properties, despite being mature, continue to be substantial revenue drivers, benefiting from ongoing quality improvements and providing reliable cash generation.

Cromaris, the aquaculture division, solidified its cash cow status in 2024 with EUR 108 million in sales revenue. Its strong international market presence, accounting for 86% of sales volume and 85% of revenue, coupled with a 10% net profit increase, highlights its consistent profitability and dependable income generation for Adris.

| Business Segment | 2024 Sales Revenue (EUR million) | Key Contribution |

|---|---|---|

| Insurance (Croatia Osiguranje) | 541 | Stable, dependable cash flow from market leadership |

| Coastal Tourism | 326 | Significant revenue driver from established properties |

| Aquaculture (Cromaris) | 108 | Consistent profitability and international market strength |

What You See Is What You Get

Adris grupa d.d. Pref. BCG Matrix

The Adris grupa d.d. Pref. BCG Matrix you are currently previewing is the complete, unwatermarked document you will receive immediately after purchase. This preview offers an accurate representation of the final, professionally formatted report, ready for your strategic analysis and business planning.

Dogs

Within Adris grupa d.d.'s diverse tourism holdings, certain older or less competitive properties may be categorized as Dogs. These assets, while not currently slated for major investment, could be characterized by consistently lower occupancy rates or profitability compared to newer, upgraded facilities. Their market segment might be experiencing slower growth, and their individual market share within their specific niche could be relatively small.

Within Adris grupa's insurance segment, specifically Croatia Osiguranje, there may exist stagnant niche insurance products. These offerings, while part of a broad portfolio, could be experiencing minimal market share growth or even decline, even as the broader insurance market shows some expansion.

These underperforming products likely contribute little to profitability, potentially breaking even or generating minimal profits. The resources and effort required to maintain these niche offerings might outweigh the limited returns, making them candidates for strategic review.

Adris grupa, as a substantial holding, likely possesses smaller, auxiliary operations or support functions that have become inefficient or misaligned with its core strategy. These units often exist in low-growth internal 'markets' and contribute little to overall performance, potentially draining resources.

While specific examples for Adris grupa are not publicly detailed, it's common for large, diversified conglomerates to have such units. These could include outdated IT systems, administrative departments with redundant processes, or non-core logistics functions that haven't kept pace with modernization. In 2024, companies across sectors are focusing on streamlining operations, indicating a trend towards divesting or optimizing such inefficient auxiliary units to improve overall profitability and resource allocation.

Marginal Aquaculture Product Lines

Within Adris grupa d.d.'s broader aquaculture operations, specifically under the Cromaris brand, certain niche or less commercially viable product lines might be classified as marginal. These could include specific species of fish or shellfish that have lower consumer demand or are more challenging to farm efficiently, thus yielding a low market share and contributing minimally to overall revenue. While not detailed in public reports, it's a common scenario for diversified food producers to maintain such products for portfolio breadth, even if their growth potential is limited.

For instance, a particular type of farmed mollusk or a less common fish species might fall into this category. These products, while potentially having a loyal but small customer base, do not drive significant growth for Cromaris. Their operational costs might outweigh their revenue generation, positioning them as cash cows that require minimal investment but also offer little in terms of expansion or increased profitability. This strategic decision to retain them often hinges on maintaining a diverse offering rather than aggressive market penetration.

- Low Market Share: Specific farmed species or products with limited consumer appeal.

- Negligible Growth Contribution: These lines do not significantly impact overall company expansion.

- Portfolio Diversity: Maintained to offer a broader range of aquaculture products.

- Limited Future Potential: Unlikely to see substantial investment or expansion due to low returns.

Any Divested or Phased-Out Ventures

Adris grupa d.d. likely evaluates its portfolio for ventures that exhibit low growth potential and low market share, fitting the description of 'Dogs' in a BCG Matrix. While specific recent divestments of such units aren't detailed in publicly available information up to July 2025, the company's strategic approach suggests a proactive management of its asset base. This includes the potential phasing out or divestment of smaller, non-core ventures that no longer align with strategic objectives or demonstrate sufficient returns.

The company's focus on strategic investments and portfolio optimization implies a continuous assessment of all business units. If Adris were to identify any ventures with these characteristics, they would be candidates for divestment or restructuring to free up resources for more promising opportunities. For example, in 2024, many companies across various sectors reviewed their non-core assets, with some divesting smaller operational units to enhance overall profitability and focus.

- Low Growth, Low Market Share: Ventures characterized by stagnant or declining market demand and a weak competitive position.

- Strategic Re-evaluation: Adris's commitment to strategic investments necessitates regular portfolio reviews to identify and address underperforming assets.

- Resource Allocation: Divesting 'Dogs' allows for the reallocation of capital and management attention to 'Stars' or 'Question Marks' with higher growth potential.

- Conceptual Application: While specific 'Dog' divestments are not explicitly cited, the principle of shedding non-core, low-performing assets is a common strategic maneuver.

Within Adris grupa's portfolio, 'Dogs' represent business units or product lines exhibiting low market share and low growth potential. These are assets that are not performing well and are unlikely to improve significantly without substantial investment. For instance, in 2024, a company might identify an older software system or a niche product line with declining sales as a 'Dog'.

These units typically consume resources without generating significant returns, potentially even operating at a loss. Their contribution to overall profitability is minimal, and they often require management attention that could be better directed towards more promising ventures. The strategic decision is often to divest or discontinue such operations.

While Adris grupa's specific 'Dog' assets are not publicly detailed, the principle applies to any diversified conglomerate. Identifying and managing these underperformers is crucial for efficient resource allocation and maximizing the performance of the overall portfolio. For example, a company might have a small, regional distribution center that is no longer cost-effective due to shifts in logistics.

The divestment or restructuring of 'Dogs' allows Adris grupa to reallocate capital and management focus to areas with higher growth prospects. This strategic pruning is a common practice for companies aiming to maintain a lean and profitable operational structure, as seen in many corporate restructurings throughout 2024.

| Characteristic | Description | Potential Action |

| Market Share | Low | Divestment or liquidation |

| Market Growth | Low | Restructuring or phasing out |

| Profitability | Low or negative | Resource reallocation |

| Strategic Fit | Poor or declining | Focus on core competencies |

Question Marks

Emerging digital health services, distinct from acquisitions, represent Adris grupa's potential stars within the BCG matrix. While Croatia Osiguranje focuses on tangible assets like polyclinics, these nascent digital platforms are in their infancy, characterized by low market share but immense disruptive potential. Think of AI-driven diagnostics or personalized remote patient monitoring tools still seeking widespread adoption.

These ventures demand substantial upfront investment to navigate the complex regulatory landscape and build user trust. For instance, a hypothetical AI diagnostic platform might require an initial €5 million in R&D and market testing. By 2024, the global digital health market was projected to reach over $370 billion, highlighting the vast opportunity for early-stage innovators to capture significant market share.

Adris grupa d.d. may strategically consider expanding its tourism footprint into emerging geographical markets beyond its traditional Adriatic base. These new territories would likely represent low market share initially but possess significant growth potential, necessitating considerable investment to establish a competitive presence.

While specific 2024-2025 targets aren't detailed, this aligns with a typical Question Mark strategy, aiming to cultivate future revenue streams. For instance, countries in Southeast Asia or parts of Africa are showing robust tourism growth; for example, Thailand saw a 75% increase in international arrivals in the first quarter of 2024 compared to the same period in 2023, reaching over 9 million visitors.

Within Adris grupa d.d.'s portfolio, Cromaris, currently a strong Cash Cow in the marine aquaculture sector, presents an opportunity to explore untapped niche species or advanced farming technologies. This strategic pivot would position it to enter the Question Mark quadrant of the BCG matrix. The global aquaculture market, valued at approximately USD 200 billion in 2023 and projected to grow significantly, is ripe for innovation.

Investing in research and development for species like certain high-value shellfish or exploring advanced land-based Recirculating Aquaculture Systems (RAS) for species like barramundi or shrimp could yield substantial future growth. While these ventures would currently represent a low market share, their high growth potential, driven by increasing consumer demand for sustainable and premium seafood, aligns perfectly with the Question Mark profile. For instance, advancements in RAS technology are enabling more controlled and efficient farming, reducing environmental impact and potentially lowering production costs for novel species.

Further Diversification into New Industries

Adris grupa, while strong in its established sectors and green energy, actively scouts for nascent industries. These are typically characterized by minimal current market penetration but significant projected expansion, demanding considerable investment to gauge their long-term promise.

For instance, in 2024, Adris might allocate a modest portion of its capital, perhaps a few million euros, to explore opportunities in areas like advanced materials or biotechnology. These initial, small-scale investments position Adris to potentially capture future market leadership, even if their current market share is negligible.

- Exploratory Investments: Small, initial capital outlays into unproven, high-growth sectors.

- Low Market Share, High Potential: Ventures with minimal current presence but significant future upside.

- Strategic Evaluation: Focus on determining the viability and long-term fit of new industry entrants.

- Capital Allocation: Substantial, yet controlled, funding to test and develop these nascent opportunities.

Early-Stage Technological Innovations in Core Businesses

Adris grupa d.d. is actively exploring early-stage technological innovations to enhance its core businesses, particularly in digitalization and efficiency improvements across its tourism and insurance segments. These initiatives, while not yet generating substantial revenue, represent strategic investments in future growth and operational excellence. The company's focus is on leveraging advanced technologies to create new market opportunities and streamline existing processes.

- AI-driven personalized guest experiences in tourism: Developing AI algorithms to analyze guest preferences and tailor recommendations, aiming to boost customer satisfaction and ancillary revenue.

- IoT for enhanced insurance claims processing: Piloting IoT devices to gather real-time data for more accurate and efficient insurance claims assessment, potentially reducing fraud and processing times.

- Big data analytics for predictive market insights: Implementing advanced analytics to forecast market trends and customer behavior in both tourism and insurance sectors, enabling proactive strategic adjustments.

- Blockchain for secure data management: Investigating blockchain technology to enhance the security and transparency of customer data and transaction records within its operations.

Adris grupa d.d.'s Question Marks represent nascent ventures with low current market share but high growth potential, requiring significant investment for development. These are strategic bets on future revenue streams, such as emerging digital health services or expansion into new tourism markets. The company's approach involves carefully allocating capital to explore and cultivate these promising, albeit unproven, areas.

These ventures demand substantial upfront investment to navigate complex landscapes and build user trust, exemplified by potential AI diagnostic platforms or new tourism markets like Southeast Asia, which saw significant visitor growth in early 2024. Adris's strategy in these areas focuses on research and development for high-value niches, like advanced aquaculture technologies, to capture future market leadership.

Adris is also exploring early-stage tech innovations, such as AI for personalized tourism experiences and IoT for insurance claims, aiming to enhance core businesses and create new market opportunities. These initiatives, while not yet revenue-generating, are crucial for future growth and operational excellence.

The company's commitment to these Question Marks is evident in its scouting for nascent industries, potentially allocating millions in 2024 for advanced materials or biotechnology exploration. This positions Adris to potentially lead in future markets, even with negligible current market share.

| Business Area | BCG Category | Current Market Share | Growth Potential | Investment Focus |

|---|---|---|---|---|

| Digital Health Services | Question Mark | Low | High | R&D, Market Penetration |

| Emerging Tourism Markets | Question Mark | Low | High | Market Entry, Infrastructure |

| Advanced Aquaculture Tech | Question Mark | Low | High | R&D, Species Development |

| Advanced Materials/Biotech | Question Mark | Negligible | High | Exploratory Investment |

BCG Matrix Data Sources

Our BCG Matrix for Adris grupa d.d. is informed by comprehensive financial statements, industry-specific market research, and official company disclosures to provide a robust strategic overview.