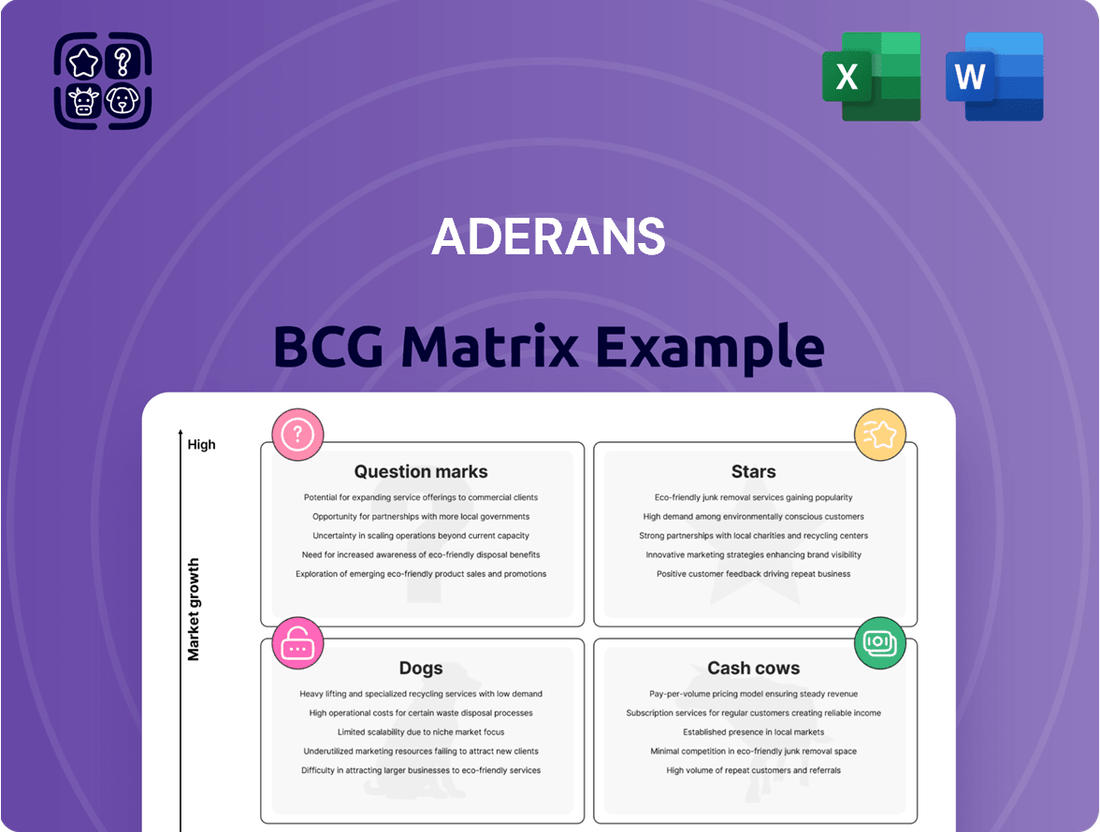

Aderans Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aderans Bundle

Unlock the strategic potential of Aderans' product portfolio with a glimpse into their BCG Matrix. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. For a comprehensive understanding and actionable insights to optimize resource allocation, purchase the full BCG Matrix report.

Stars

Aderans' strategic move into hair regeneration cell therapy, through an exclusive licensing deal with Stemson Therapeutics, places it squarely in a high-growth, innovative sector. This partnership is designed to leverage Stemson's proprietary technology, aiming to revitalize the hair loss treatment market.

The focus is on resuming Phase 2 clinical trials, a critical step towards commercialization. By integrating Aderans' existing technology with Stemson's pipeline, the company is building a robust foundation for future hair loss solutions, signaling significant growth potential in this specialized therapeutic area.

Aderans' strategic push to expand Bosley's renowned hair transplantation services into Europe and Asia signifies a bold move into new, high-potential markets. This initiative is designed to leverage Bosley's established US success and transform it into a global powerhouse in the hair restoration industry.

By targeting Europe and Asia, Aderans aims to tap into burgeoning demand for cosmetic procedures, significantly increasing Bosley's market presence. The company anticipates substantial revenue growth from these international ventures, solidifying its position as a leader in the global hair restoration sector.

Aderans' advanced artificial hair fibers, including VITALHAIR, Cyberhair, and the newer CYBER X, represent a significant investment in research and development. These proprietary fibers are designed to mimic natural hair in appearance, texture, and styling capabilities, addressing a growing market need for high-quality, realistic hair replacement solutions. The company's patent portfolio across several countries underscores its commitment to innovation in this segment.

The market for advanced hair fibers is experiencing robust growth, driven by increasing consumer awareness and demand for sophisticated solutions. Aderans' strategic focus on these high-performance materials positions them strongly within the artificial hair industry, aiming to capture a larger share of this expanding market. The company's ongoing efforts in material science are crucial for maintaining this competitive edge.

AI-Generated Wig Models and Digital Transformation

Aderans' integration of AI-generated wig models into its online store signifies a strategic move towards enhancing digital customer engagement and expanding its e-commerce presence. This innovation is designed to offer customers more diverse and relatable visual representations of their products, thereby improving the online shopping experience and potentially increasing conversion rates in the burgeoning online wig market.

This initiative aligns with Aderans' broader digital transformation efforts, aiming to capture a greater market share by leveraging cutting-edge technology. The company's focus on digital customer experience is crucial, especially as the global e-commerce market for beauty and personal care products continues its upward trajectory. For instance, the global online beauty market was valued at over $200 billion in 2023 and is projected to grow significantly in the coming years.

- Enhanced Visualization: AI models provide a more personalized and realistic view of wigs, aiding customer purchasing decisions.

- Digital Transformation: This adoption is a key component of Aderans' strategy to modernize its customer interface and sales channels.

- Market Share Growth: By improving online appeal, Aderans aims to attract and retain more customers in the competitive online wig sector.

- Customer Relatability: Offering a wider array of AI-generated models can better reflect the diverse customer base, fostering a stronger connection.

Strategic Salon Partnerships

Aderans is actively strengthening its strategic alliances with hair salons and barbershops, a move that underscores a commitment to broadening its market presence and capturing a larger share through established retail outlets. This strategy capitalizes on existing networks to fuel expansion and achieve deeper penetration for its wide array of hair care products and services.

This focus on salon partnerships is a key component of Aderans' growth strategy, allowing them to tap into the trust and customer loyalty already built by these local businesses. By integrating their offerings within these frequented establishments, Aderans aims to enhance brand visibility and accessibility.

- Market Penetration: Partnerships allow Aderans to reach customers directly through trusted salon environments, a critical channel for hair solutions.

- Distribution Network: Leveraging existing salon networks expands Aderans' distribution reach without the need for extensive independent store build-outs.

- Brand Synergy: Collaborating with salons can create a natural synergy, aligning Aderans' brand with professional hair care expertise.

Stars in the BCG Matrix represent high-growth, high-market-share business units. For Aderans, the hair regeneration cell therapy through its partnership with Stemson Therapeutics is a prime example of a potential Star. This venture taps into a rapidly expanding market driven by scientific advancements and increasing consumer demand for effective hair loss solutions.

The ongoing Phase 2 clinical trials for hair regeneration therapy indicate a commitment to innovation and future market leadership. Success in this area could position Aderans as a dominant player in a segment projected for significant growth, aligning perfectly with the characteristics of a Star business unit.

Aderans' strategic expansion of Bosley's hair transplantation services into Europe and Asia also aligns with Star characteristics. These new markets offer substantial growth opportunities, and Bosley's established brand recognition provides a strong foundation for capturing high market share in these regions.

The company's investment in advanced artificial hair fibers, like VITALHAIR and Cyberhair, also shows Star potential. The market for these high-performance materials is growing, and Aderans' proprietary technology and patent portfolio give it a competitive advantage to achieve high market share in this expanding segment.

What is included in the product

The Aderans BCG Matrix categorizes business units by market share and growth rate, guiding investment decisions.

Aderans BCG Matrix: A visual tool to strategically allocate resources, relieving the pain of uncertain investment decisions.

Cash Cows

Aderans' custom-made wigs for men and women represent a classic Cash Cow within their portfolio. This segment benefits from a dominant market share in a mature, yet perpetually relevant, industry. The enduring demand for quality and personalized wig solutions ensures a consistent and substantial generation of cash flow for the company.

Fontaine, Aderans' well-established fashion wig brand, is a prime example of a Cash Cow within the company's BCG Matrix. Its strong foothold in the mature women's ready-made wig market, distributed through department stores and its own retail outlets, ensures a steady stream of income.

The brand benefits from high market recognition, allowing it to generate consistent revenue with minimal need for aggressive promotional spending. This mature segment, while not experiencing rapid growth, provides a reliable financial foundation for Aderans.

HairClub, Aderans' non-surgical hair restoration and hair loss prevention service, is a prime example of a cash cow within the BCG matrix. Its designation as Aderans' Company of the Year for 2024 underscores its robust performance and dominant position in a well-established market.

This segment commands a high market share within the mature hair restoration industry. In 2023, Aderans reported that its Hair and Beauty segment, which includes HairClub, generated approximately ¥118.6 billion in revenue, showcasing its substantial contribution to overall cash flow.

Bosley's Established US Hair Transplantation Services

Bosley, a prominent player in the US hair transplantation market, functions as a cash cow for its parent company, Aderans. This segment of the business benefits from a mature yet stable demand for surgical hair restoration procedures.

The established brand recognition and widespread operational footprint of Bosley translate into consistent and predictable revenue streams. This reliable cash flow is crucial, enabling Aderans to allocate resources towards growth initiatives or to offset investments in other business units.

- Market Position: Bosley holds a significant share in the US hair transplantation market, a sector characterized by steady demand.

- Revenue Generation: The service's mature nature ensures consistent cash flow, vital for supporting the broader Aderans portfolio.

- Brand Strength: Bosley's established reputation contributes to its ability to maintain market presence and profitability.

- Financial Contribution: As a cash cow, Bosley provides essential financial stability to the Aderans Group.

Traditional Salon Services

Aderans' traditional salon services, encompassing cutting, styling, and coloring, represent a classic Cash Cow within its business portfolio. These are the bedrock offerings that consistently draw customers, providing a stable and predictable income stream. While the overall beauty industry may see shifts, the demand for these core services remains resilient, ensuring a reliable source of cash for the company.

- Stable Revenue Generation: Traditional salon services contribute significantly to Aderans' consistent revenue, acting as a reliable financial anchor.

- Mature Market Position: These services operate in a mature market, characterized by steady demand rather than rapid expansion, fitting the Cash Cow profile.

- Cash Flow Generation: The consistent customer base and established service model ensure these operations generate substantial positive cash flow, funding other business ventures.

- Industry Data: In 2024, the global salon services market was valued at approximately $100 billion, with traditional services forming a substantial portion of this, underscoring their enduring economic importance.

Aderans' established salon services, including cutting, styling, and coloring, are quintessential Cash Cows. They benefit from a mature market with consistent demand, providing a stable financial foundation. These services reliably generate substantial cash flow, enabling Aderans to invest in other areas.

The global salon services market, valued at approximately $100 billion in 2024, highlights the enduring economic significance of traditional offerings like those provided by Aderans.

| Aderans Business Unit | BCG Category | Market Characteristic | 2023 Revenue Contribution (Approximate) |

|---|---|---|---|

| Custom-made Wigs (Men & Women) | Cash Cow | Mature, High Market Share | Significant |

| Fontaine Fashion Wigs | Cash Cow | Mature, High Brand Recognition | Substantial |

| HairClub (Non-surgical Hair Restoration) | Cash Cow | Mature, Dominant Position | Part of ¥118.6 billion Hair & Beauty Segment |

| Bosley (US Hair Transplantation) | Cash Cow | Mature, Stable Demand | Consistent Revenue Stream |

| Traditional Salon Services | Cash Cow | Mature, Resilient Demand | Bedrock of Consistent Income |

What You’re Viewing Is Included

Aderans BCG Matrix

The Aderans BCG Matrix you're previewing is the definitive, fully formatted document you will receive immediately after purchase, complete with all analytical data and strategic insights. This comprehensive report has been meticulously prepared, ensuring it is ready for immediate application in your business planning and decision-making processes. You can trust that the content and layout you see here are precisely what you will download, offering a clear and actionable framework for evaluating Aderans' business portfolio.

Dogs

The dissolution of Aderans Korea, Inc. in 2024 signals a business segment that underperformed, failing to meet growth or market share objectives. This strategic withdrawal suggests the Korean market, for Aderans, became a 'Dog' in its portfolio, likely due to intense competition or declining demand for its services.

The divestiture of Aderans BIO Co., Ltd. in 2024, a venture focused on antibacterial and antiviral products, indicates it likely fell into the Dogs category of the BCG matrix. This strategic move suggests the business unit did not achieve sufficient market traction or profitability, signaling a low-growth, low-market-share position from which Aderans decided to exit.

In 2024, Aderans strategically divested Amekor Industries, Inc. and Estetica Designs, Inc. These acquisitions were initially intended to capture a significant share of the African-American wig market. However, the divestiture signals that these ventures did not achieve their projected market penetration or growth objectives.

The decision to sell Amekor and Estetica suggests they were categorized as Dogs within Aderans' portfolio. This classification implies that their performance and future prospects were deemed insufficient to warrant continued investment, leading to their removal from the company's strategic holdings.

Outdated Wig Stopper and Net Foundation Technologies

Within Aderans' product portfolio, older iterations of wig stoppers and net foundations, characterized by lower user-friendliness or visibility, would likely be classified as Dogs in the BCG Matrix. These technologies face a shrinking market as consumers gravitate towards more sophisticated and aesthetically pleasing alternatives.

The market for such legacy products is diminishing, reflecting a broader trend of technological advancement and evolving consumer expectations in the hair solutions industry. For instance, by 2024, the demand for basic, less integrated hairpiece components has seen a noticeable decline compared to the rising popularity of seamless, integrated hair systems.

- Declining Market Share: Older wig stoppers and net foundations are losing ground to newer, more discreet, and secure attachment methods.

- Low Growth Prospects: The segment for these foundational technologies is not experiencing significant growth, as innovation focuses on advanced materials and designs.

- Reduced Investment Focus: Aderans would likely de-emphasize investment in these outdated technologies, redirecting resources towards their Stars and Question Marks.

Niche, Low-Volume Legacy Wig Collections

Niche, low-volume legacy wig collections would likely be classified as Dogs in the Aderans BCG Matrix. These are often older styles or highly specialized designs serving very small or declining customer bases. Aderans, like many in the beauty and personal care sector, faces evolving consumer trends, meaning collections that don't adapt can quickly become outdated. For example, while specific historical or theatrical wig lines might have a dedicated following, their overall market share is typically minuscule, making them candidates for divestment or minimal investment.

These collections typically exhibit low market share and low market growth. For instance, if a specific vintage wig style only accounts for less than 1% of Aderans' total wig sales and the market for that style is projected to grow at less than 2% annually, it fits the Dog profile. Such products often require continued, albeit minimal, marketing and inventory management, tying up capital without generating substantial profits, potentially impacting Aderans' overall profitability metrics.

- Low Market Share: Collections catering to highly specific, often shrinking, demographic niches.

- Low Market Growth: Demand for these legacy styles is not expanding and may be declining.

- Resource Drain: Continued inventory, marketing, and management costs outweigh revenue generation.

- Strategic Consideration: Often candidates for discontinuation or sale to free up resources for more promising product lines.

Dogs represent business units or products with low market share in a low-growth industry. Aderans' divestiture of Aderans Korea, Inc. and ventures like Amekor Industries, Inc. and Estetica Designs, Inc. in 2024 exemplifies this classification. These businesses, failing to meet growth objectives or achieve significant market traction, were likely categorized as Dogs due to their underperformance and limited future prospects.

Legacy products, such as older wig stoppers and net foundations, also fall into the Dog category. These items face diminishing demand as newer, more advanced alternatives emerge, indicating low market share and minimal growth potential. Similarly, niche, low-volume legacy wig collections that do not adapt to evolving consumer trends are prime candidates for the Dog classification, often representing a drain on resources.

The strategic decision to divest or de-emphasize these Dog segments allows Aderans to reallocate capital and focus on more promising areas of its portfolio. For example, by exiting underperforming markets or product lines, the company can invest in its Stars and Question Marks, aiming for future growth and profitability. This strategic pruning is crucial for maintaining a healthy and dynamic business portfolio.

Aderans' approach to managing its Dog segments in 2024 highlights a commitment to portfolio optimization. The divestiture of businesses that no longer align with market demands or strategic objectives is a common practice for companies seeking to improve overall financial performance. This proactive management of underperforming assets is key to long-term success in the competitive hair solutions industry.

Question Marks

Aderans is actively investing in early-stage hair regeneration, exemplified by its collaboration with Stemson Therapeutics and its deep dive into induced pluripotent stem cell (iPS) technology. This focus on groundbreaking R&D positions Aderans in a high-growth potential market segment, even though its current market share in this nascent field is minimal.

These capital-intensive research endeavors, while carrying significant risk, hold the promise of becoming future market leaders, or Stars, within the hair loss solutions industry. The success of these initiatives is crucial for Aderans' long-term growth trajectory, as they aim to develop novel, highly effective treatments.

Bosley's move into Europe and Asia, while potentially lucrative, places it in the Question Mark quadrant of the Aderans BCG Matrix for these new territories. This means significant investment is required to build brand awareness and operational infrastructure, mirroring the high growth potential often seen in emerging markets.

The success of this expansion hinges on Aderans' ability to adapt its proven US model to diverse cultural and regulatory landscapes. For instance, the European hair restoration market, while growing, presents varied reimbursement policies and consumer preferences compared to the US, demanding tailored strategies. Similarly, Asia's market dynamics, from Japan to Southeast Asia, require distinct approaches to marketing and service delivery.

BeauStage represents Aderans' strategic expansion into the burgeoning beauty and health sector, leveraging its core expertise in hair and scalp technology for innovative skincare solutions and devices. This move targets a wellness market experiencing significant global growth. For instance, the global beauty and personal care market was valued at approximately $511 billion in 2023 and is projected to reach over $784 billion by 2030, indicating substantial opportunity.

As a relatively new entrant, BeauStage likely occupies a low market share position within this competitive landscape, characteristic of a question mark in the BCG matrix. However, its high growth potential stems from the increasing consumer demand for science-backed, results-oriented skincare and the cross-application of Aderans' established technological capabilities.

Joint Research on Novel Hair Materials (e.g., with Spiber Inc.)

Aderans' collaboration with Spiber Inc. on novel hair materials, derived from structural proteins, highlights a strategic push into a high-potential, emerging market. This research and development effort, while currently in its nascent stages, positions Aderans to capture future growth in sustainable and advanced hair solutions.

The early-stage nature of this initiative means it likely possesses a low current market share. However, the innovative technology and the growing demand for eco-friendly alternatives suggest significant future market penetration, characteristic of a Question Mark in the BCG matrix.

- Innovation Focus: Development of next-generation hair materials using advanced biotechnology, such as Spiber's protein fermentation.

- Market Potential: Addresses growing consumer demand for sustainable and ethically sourced beauty products.

- R&D Investment: Significant upfront investment in research and development with uncertain but potentially high future returns.

- Competitive Landscape: Aims to disrupt traditional hair material sourcing with novel, bio-engineered alternatives.

New Evaporative Cooling Materials for Wig Foundations

Aderans' introduction of new evaporative cooling materials for wig net foundations in 2025 positions this innovation as a potential 'Question Mark' within the BCG matrix. This signifies a commitment to cutting-edge product development aimed at boosting user comfort in an increasingly competitive market for advanced wig solutions.

The market for comfortable and technologically enhanced wig solutions is experiencing growth, with the global wig market projected to reach approximately USD 13.0 billion by 2026, growing at a CAGR of 7.5% according to some market analyses. However, Aderans' new cooling technology has a nascent market share, necessitating strategic investment to drive wider adoption and establish a stronger foothold.

- Innovation Focus: New evaporative cooling materials for wig foundations launched in 2025.

- Market Context: Entering a growing market for comfortable and advanced wig solutions.

- Market Share: Currently nascent, requiring further investment for significant capture.

- Strategic Implication: Potential 'Question Mark' in BCG matrix, demanding careful resource allocation to assess future growth potential.

Question Marks in Aderans' portfolio represent ventures with high growth potential but low current market share. These are often new product lines or market entries that require significant investment to gain traction. The success of these ventures is uncertain, and they need careful evaluation to determine if they will evolve into Stars or be divested.

Aderans' expansion into new geographical markets, like Bosley's European and Asian ventures, and its development of novel materials through collaborations such as with Spiber Inc., exemplify these Question Marks. These initiatives are characterized by substantial R&D or market development costs, with the future payoff yet to be realized.

The introduction of new technologies, such as evaporative cooling materials for wig foundations, also falls into this category. These products are entering a growing market but need strategic investment to build awareness and capture market share, making their future performance a key question.

The BeauStage initiative, targeting the beauty and wellness sector with science-backed skincare, is another prime example of a Question Mark. While the market is large and growing, Aderans' position as a new entrant necessitates investment to establish its presence and compete effectively.

| Business Unit/Initiative | BCG Category | Market Growth Rate | Relative Market Share | Strategic Focus |

|---|---|---|---|---|

| Bosley (Europe & Asia Expansion) | Question Mark | High | Low | Market penetration, brand building |

| Spiber Inc. Collaboration (Novel Hair Materials) | Question Mark | High | Low | R&D, product development |

| BeauStage (Beauty & Wellness) | Question Mark | High | Low | Market entry, product innovation |

| Evaporative Cooling Wig Materials (2025 Launch) | Question Mark | Moderate to High | Low | Product development, market adoption |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.