ADENTRA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADENTRA Bundle

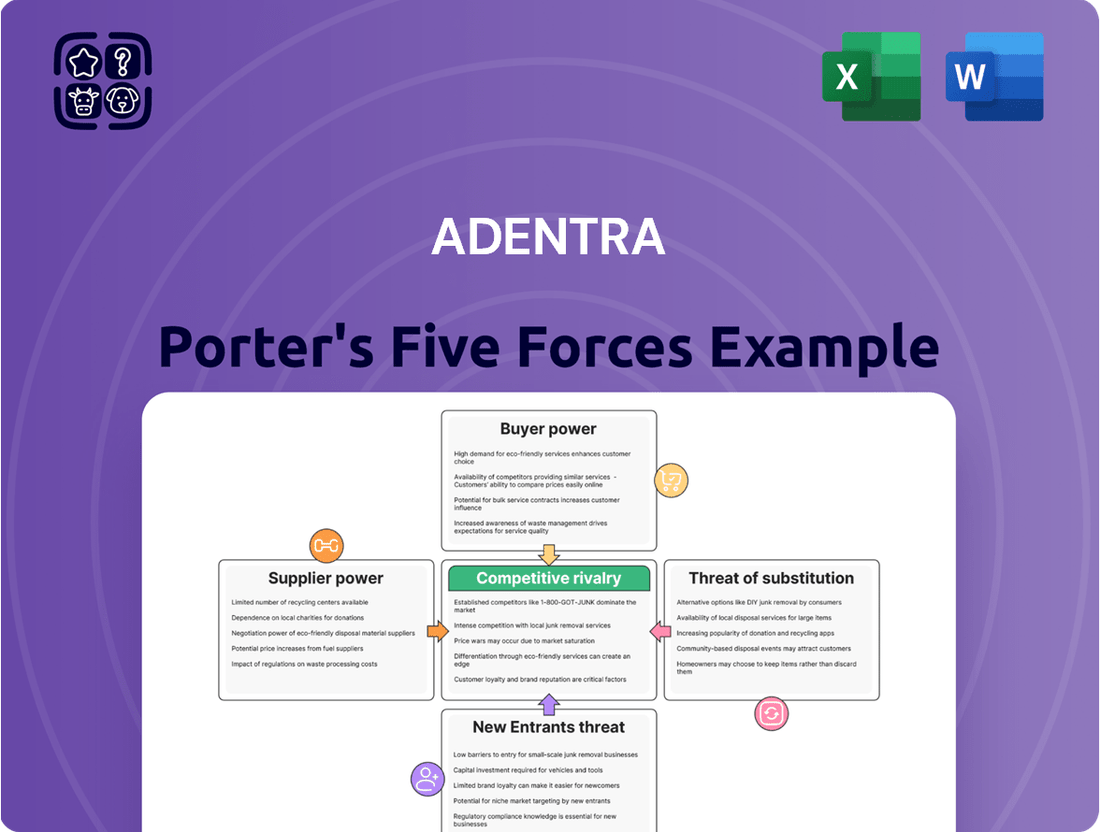

ADENTRA operates within a dynamic market, and understanding its competitive landscape is crucial. Our Porter's Five Forces analysis delves into the intricate interplay of buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the availability of substitutes. This framework illuminates the forces that truly shape ADENTRA's industry, offering a clear view of both opportunities and challenges.

The complete report reveals the real forces shaping ADENTRA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ADENTRA sources products from a diverse array of domestic and international manufacturers. While the overall number of suppliers is large, certain specialized categories, like architectural glass or metal components, exhibit concentration. Here, a few major players can diminish ADENTRA's leverage, especially when offering unique or patented products. This contrasts with more fragmented segments where ADENTRA maintains stronger bargaining power. For instance, as of 2024, ADENTRA's strategic sourcing aims to balance these dynamics across its product portfolio.

As one of North America's largest distributors of architectural products, ADENTRA represents a vital sales channel for its suppliers. The company's substantial purchasing volume, evidenced by its significant revenue, grants it considerable bargaining power. Suppliers are often highly dependent on ADENTRA for access to a broad customer base across the continent, making the relationship crucial for their own sales targets. This scale allows ADENTRA to negotiate highly favorable pricing and terms, a distinct advantage over smaller, regional competitors in the market as of 2024.

For standardized products, ADENTRA faces relatively low costs when switching between suppliers. However, exclusive or semi-exclusive product lines present higher switching barriers, demanding new supplier vetting and agreement negotiations. This also risks losing unique products that differentiate ADENTRA's market offerings. To counter this, ADENTRA actively maintains a broad and diverse global sourcing network, spanning over 30 countries as of 2024. This strategic diversification helps mitigate supplier power by ensuring multiple sourcing options.

Threat of Forward Integration

The threat of suppliers integrating forward to bypass ADENTRA and sell directly to end-customers remains low. Establishing a distribution network comparable to ADENTRA’s 86 facilities across North America would demand immense capital investment and specialized logistical expertise. Suppliers generally find it more efficient to partner with established distributors like ADENTRA, which served over 40,000 customers in 2024. This existing infrastructure makes direct competition highly impractical for most suppliers.

- ADENTRA's 86 North American facilities present a significant barrier.

- Suppliers face immense capital and logistical hurdles for direct distribution.

- Over 40,000 customers were served by ADENTRA in 2024.

- Partnering with established distributors is more cost-effective for suppliers.

Availability of Substitute Inputs

For many of ADENTRA’s product categories, like standard doors and commodity building materials, numerous substitute products are readily available from a wide array of manufacturers. This broad availability significantly limits the bargaining power of any single supplier, as ADENTRA can easily shift to alternative products if a supplier's terms become unfavorable or prices escalate. However, for highly specialized or exclusive branded architectural products, the market for substitutes is much narrower, which slightly enhances supplier power within those specific niches. The company's diverse product portfolio, as noted in its Q1 2024 financial reports, reflects this balance.

- Standard products offer high substitutability, reducing supplier leverage.

- ADENTRA benefits from a large pool of alternative suppliers for core materials.

- Specialized architectural products have fewer direct substitutes, increasing niche supplier influence.

- Strategic sourcing mitigates supplier power across ADENTRA's varied product lines.

ADENTRA’s vast purchasing volume and role as a crucial sales channel for suppliers significantly reduce supplier bargaining power, especially for standardized products with many alternatives. However, specialized or patented items, like certain architectural glass as of 2024, can increase supplier leverage due to fewer options and higher switching costs. The low threat of forward integration by suppliers, given ADENTRA's extensive North American distribution network of 86 facilities, further strengthens ADENTRA's position. This dynamic allows ADENTRA to generally negotiate favorable terms across its diverse product portfolio.

| Factor | Impact on Supplier Power | 2024 Context |

|---|---|---|

| ADENTRA's Purchasing Volume | Lowers supplier power | Significant revenue base |

| Supplier Dependence on ADENTRA | Lowers supplier power | Access to 40,000+ customers |

| Availability of Substitutes | Lowers for standard products | Broad vendor network over 30 countries |

| Threat of Forward Integration | Lowers supplier power | 86 North American facilities, high capital barrier |

What is included in the product

This ADENTRA Porter's Five Forces analysis dissects the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly identify and prioritize competitive threats with a comprehensive, visual breakdown of all five forces.

Effortlessly adapt to market shifts by dynamically adjusting inputs and observing their impact on competitive intensity.

Customers Bargaining Power

ADENTRA boasts a highly fragmented customer base, serving over 75,000 diverse clients including contractors, home centers, original equipment manufacturers, and architects. This broad distribution ensures that no single customer represents a material portion of ADENTRA's total sales, significantly diminishing their individual bargaining power. For example, as of their 2023 financial reporting, no customer accounted for more than 10% of net sales. The loss of any one customer would therefore have a negligible impact on ADENTRA's overall financial performance and stability in 2024.

The construction and renovation markets, particularly in the residential and repair/remodel segments, exhibit significant price sensitivity. Customers, especially large contractors and major home centers like those seeing continued demand in early 2024, wield considerable purchasing power, often pressuring distributors like ADENTRA for lower prices. ADENTRA mitigates this by offering a broad range of products across various price points, ensuring options for diverse customer needs. Furthermore, they provide value-added services such as an expansive distribution network and deep product expertise, which helps differentiate their offerings beyond just price.

Customer switching costs for ADENTRA vary, though the company’s operational strengths create moderate barriers. While some building products can be seen as commodities, ADENTRA’s extensive inventory, reportedly over 60 distribution centers as of 2024, and reliable delivery capabilities significantly enhance customer stickiness. Established relationships and a consistent supply chain make contractors and OEMs hesitant to switch to less reliable or smaller-scale distributors. This continuity is crucial for project timelines, making the perceived cost of disruption higher than simply comparing product prices.

Threat of Backward Integration

The threat of backward integration from ADENTRA’s large customers, like major home centers or contractors, remains low. Replicating ADENTRA’s extensive distribution network, which includes over 60 facilities across North America as of early 2024, would demand substantial capital investment. This includes significant outlays for warehousing, advanced logistics systems, and establishing deep supplier relationships. Customers typically find it more cost-effective to rely on specialized distributors like ADENTRA rather than incur these high fixed costs and operational complexities. ADENTRA’s efficiency in delivering a broad product portfolio makes in-house distribution economically unfeasible for most clients.

- ADENTRA operates over 60 North American distribution facilities as of early 2024.

- Customers would face significant capital expenditure for warehousing and logistics.

- Replicating ADENTRA’s established supplier relationships presents a high barrier.

- It is generally more cost-effective for customers to outsource distribution.

Product Differentiation and Information

ADENTRA effectively mitigates customer bargaining power through its highly differentiated product portfolio. Unlike commodity building materials, the company offers specialized architectural products, many of which are exclusive or high-value. This unique offering, coupled with ADENTRA's expertise and support for architects and designers, creates significant demand. Such differentiation reduces direct price comparisons, as customers prioritize the specific features and trusted service over lowest cost. For example, ADENTRA’s 2024 focus on premium decorative surfaces and specialty panel products reinforces this strategy, making customers less sensitive to price fluctuations.

- ADENTRA's portfolio includes specialized and exclusive architectural products.

- Expertise and support provided to architects enhance product value.

- Differentiation reduces direct price comparisons for customers.

- This strategy lowers the overall bargaining power of customers.

ADENTRA faces low customer bargaining power due to a highly fragmented base of over 75,000 clients, with no single customer exceeding 10% of 2023 net sales. While price sensitivity exists, ADENTRA mitigates this with a broad product range and value-added services. High switching costs, supported by 60+ distribution centers as of 2024, and the low threat of backward integration further limit customer leverage. The company's differentiated portfolio of specialized architectural products also reduces direct price comparisons.

| Factor | ADENTRA's Position | Impact on Bargaining Power (2024) |

|---|---|---|

| Customer Fragmentation | Over 75,000 clients; no single client >10% of 2023 sales | Low individual customer leverage |

| Switching Costs | Extensive network (60+ distribution centers) | Moderate to high, fosters stickiness |

| Backward Integration Threat | High capital for replicating 60+ facilities | Very low, economically unfeasible for customers |

Preview the Actual Deliverable

ADENTRA Porter's Five Forces Analysis

This preview showcases the complete ADENTRA Porter's Five Forces analysis, offering a deep dive into the competitive landscape of the company. You're viewing the exact, professionally crafted document that will be delivered to you instantly upon purchase, ensuring no surprises or missing sections. This comprehensive analysis meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within ADENTRA's industry. The document you see here is the final, ready-to-use version, providing valuable strategic insights for your business decisions.

Rivalry Among Competitors

The North American architectural products distribution industry remains highly fragmented, primarily composed of many small, regional players. ADENTRA, with its significant scale, reporting approximately $3.4 billion in revenue for 2023, benefits from a national footprint and a robust balance sheet. This scale and diversified portfolio provide a distinct advantage over smaller, localized firms. However, the sheer number of competitors fosters intense price competition in specific regions and product segments, impacting margins. Despite its size, ADENTRA must continually leverage its operational efficiencies against this widespread rivalry.

The construction market, encompassing new residential, commercial, and repair/remodel sectors, experiences cyclical growth influenced by economic factors like interest rates and consumer confidence. Slower market growth intensifies rivalry as companies like ADENTRA compete for fewer projects. For instance, in early 2024, elevated mortgage rates, often above 7% for a 30-year fixed loan, contributed to affordability constraints, impacting new home sales and renovation activity. Conversely, periods of robust growth, driven by strong housing demand or infrastructure spending, can lessen competitive pressure, allowing more players to thrive.

ADENTRA's competitive advantage stems from its broad product portfolio, featuring exclusive and semi-exclusive lines, rather than just price. Its extensive North American distribution network, covering over 1.2 million square feet across 80+ facilities in 2024, ensures efficient and timely delivery. Competitors range from large distributors like Doman Building Materials Group Ltd. to smaller, specialized regional suppliers. The ability to offer a comprehensive one-stop-shop solution and reliable logistics across its wide footprint significantly differentiates ADENTRA. This unique blend of product depth and distribution prowess helps mitigate direct competitive rivalry.

Acquisition-Based Growth Strategy

ADENTRA effectively leverages an acquisition-based growth strategy to enhance its competitive position. Strategic purchases, like the 2023 acquisition of Woolf Distributing Company, allow ADENTRA to consolidate the fragmented building materials market. This approach expands its geographic footprint and customer channels, directly reducing the number of direct competitors by absorbing them. Smaller rivals often lack the significant capital and operational capacity required for similar large-scale expansion, making it difficult to compete with ADENTRA’s growing market share. In 2023, ADENTRA reported net sales of $1.5 billion, underscoring its financial capacity for such strategic growth initiatives. This strategy solidifies ADENTRA's market leadership.

- ADENTRA's 2023 net sales reached $1.5 billion, supporting its acquisition capacity.

- The acquisition of Woolf Distributing Company in 2023 exemplifies this strategy.

- This approach consolidates the fragmented building materials market.

- Smaller competitors struggle to match ADENTRA's capital-intensive expansion.

Impact of Economic Headwinds

Economic headwinds, marked by product price deflation and slower sales volumes observed in 2024 and continuing into early 2025, intensify competitive rivalry within the market. These challenging conditions compel all participants to aggressively vie for market share and profitability. ADENTRA's robust financial management, evidenced by its ability to manage costs, sustain gross margins above 25% in 2024, and generate strong cash flow, positions it resiliently against less stable competitors. This financial strength allows ADENTRA to navigate downturns more effectively, maintaining its competitive edge.

- 2024 product price deflation impacted revenue growth.

- Slower sales volumes persisted into Q1 2025.

- ADENTRA maintained 2024 gross margins above 25%.

- Strong cash flow generation supported operations.

Competitive rivalry for ADENTRA remains high within a fragmented North American market, intensified by 2024 product price deflation and slower sales into early 2025. ADENTRA's national scale, broad product portfolio, and extensive distribution network of over 80 facilities in 2024 provide a significant advantage. Strategic acquisitions consolidate the market, while its financial strength, including 2024 gross margins above 25%, mitigates competitive pressures.

| Metric | 2024 Data | Impact |

|---|---|---|

| Distribution Facilities | 80+ | Mitigates rivalry via reach |

| Gross Margin | >25% | Financial resilience |

| Product Price Deflation | Observed | Intensifies competition |

SSubstitutes Threaten

The threat of substitution for ADENTRA is moderate, as builders and designers have a wide array of alternative materials at their disposal for architectural elements. For instance, instead of traditional wood products, options include engineered wood composites, various metals like aluminum or steel, and diverse plastics, all serving similar applications in doors and surfaces. The selection often hinges on factors such as cost-effectiveness—with some composite panels offering up to 20% savings over solid wood in 2024—durability requirements, aesthetic preferences, and adherence to evolving building codes.

Ongoing innovation in building materials constantly introduces substitute products, posing a threat to ADENTRA. For instance, the market for sustainable building materials is projected to grow significantly, with a 2024 valuation reflecting increasing demand for eco-friendly alternatives. Developments in high-performance glass, like smart glass, and advanced composite materials, such as fiber-reinforced polymers, could replace traditional wood-based products. ADENTRA must continually update its distribution portfolio to include these innovative solutions to remain competitive and capture emerging market share.

For ADENTRA's end-users, the cost of switching to substitute building materials varies significantly. If a construction project is already designed around specific wood or panel products, changing to an alternative like steel or concrete can demand substantial redesign, potentially increasing project costs. However, for new projects, material selection offers greater flexibility, with switching costs primarily reflecting the direct price difference between options. This flexibility means the threat of substitution for ADENTRA is notably higher for new builds, as material choice in 2024 is less constrained by prior design commitments.

Direct-from-Manufacturer and DIY Trends

While not a direct product substitute, a potential threat for ADENTRA arises from evolving procurement models. The surge in e-commerce and direct-to-consumer channels could, in specific instances, enable customers to bypass traditional distributors. However, for the vast majority of commercial and residential construction projects, the extensive logistics and scale provided by a distributor like ADENTRA remain significantly more efficient than sourcing directly from numerous manufacturers. This efficiency is underscored by the complexity of managing diverse material flows for large-scale builds. For example, ADENTRA’s Q1 2024 sales showed continued reliance on their distribution network, indicating the sustained value of their integrated supply chain.

- Direct-to-consumer sales for building materials, while growing, still represent a minority of the overall market.

- Large-scale construction projects prioritize efficiency and consolidated sourcing over fragmented direct purchases.

- ADENTRA’s established logistical infrastructure provides a competitive moat against direct sourcing.

- The total value of building materials distributed through traditional channels remains dominant in 2024.

Price-Performance of Substitutes

The ultimate customer decision often hinges on the price-performance trade-off of substitute building materials. A cheaper alternative might lack the durability or aesthetic appeal provided by ADENTRA's offerings. For instance, while some composite lumber might be less expensive upfront, it may not match the longevity or natural look of certain hardwood products ADENTRA distributes. ADENTRA mitigates this threat by offering a diverse portfolio, enabling customers to make these trade-offs within their product ecosystem, minimizing sales loss to outside substitutes.

- ADENTRA's diverse product range includes over 60,000 SKUs as of early 2024.

- Customers balance initial cost against long-term performance and visual appeal.

- The company's strategy aims to capture sales across various price points and quality tiers.

- This internal optionality reduces the impetus for customers to seek external substitutes.

The threat of substitutes for ADENTRA is moderate due to a wide array of alternative building materials, including engineered wood and various metals. Ongoing innovation, especially in sustainable materials, consistently introduces new options, with the sustainable building materials market showing significant growth in 2024. Switching costs vary; they are higher for existing projects but lower for new construction, where material selection is more flexible.

ADENTRA mitigates this threat by offering a diverse product portfolio of over 60,000 SKUs as of early 2024, enabling customers to balance price and performance within their offerings. While direct-to-consumer channels pose a minor threat, ADENTRA’s established logistical infrastructure remains crucial for large-scale projects, as evidenced by Q1 2024 sales relying on their robust distribution network.

| Factor | Impact | 2024 Data |

|---|---|---|

| Material Alternatives | Moderate Threat | Composite panel savings: 20% |

| Sustainable Materials | Growing Threat | Market valuation: Significant growth |

| ADENTRA SKUs | Mitigation | Over 60,000 products |

Entrants Threaten

Establishing a comprehensive distribution network, mirroring ADENTRA's scale, demands immense capital. New entrants face substantial investment requirements for facilities, extensive inventory, and a dedicated logistics fleet. ADENTRA's operational footprint of 86 facilities across North America as of 2024 exemplifies this significant barrier. This high initial cost effectively deters most potential competitors from entering the market at a national level.

ADENTRA, as a significant player in the building materials distribution sector, leverages substantial economies of scale. In 2024, its large-volume purchasing power allows it to secure highly favorable pricing agreements with suppliers, optimizing its cost structure. A new entrant would face immense difficulty matching this scale, incurring higher per-unit costs for materials and logistics. This considerable cost disadvantage acts as a robust barrier, making it challenging for newcomers to compete effectively on price with ADENTRA's established efficiency.

ADENTRA boasts a robust global sourcing network and cultivates strong, long-term supplier relationships, making it challenging for new entrants to compete. Replicating these established ties, which include access to over 2,000 suppliers by early 2024, is time-consuming and costly. New companies would struggle to secure a similar breadth of products, especially exclusive lines like those contributing to ADENTRA's over $2 billion in annual net sales. Furthermore, gaining access to critical distribution channels in this industry acts as a significant barrier for any potential newcomer.

Brand Recognition and Customer Loyalty

ADENTRA, with its flagship brands like AIFP and Boise Cascade, possesses significant brand recognition and a strong market reputation, making it tough for new companies to break in. Contractors and other customers typically rely on the proven reliability and service of their established distributors for building materials. A new entrant would face substantial hurdles, requiring immense investment in marketing and sales to build trust and loyalty comparable to ADENTRA's existing base.

- ADENTRA reported net sales of $1.5 billion in Q1 2024, reflecting its market presence.

- Customer relationships in the distribution sector are often long-term, built on consistent product availability and service.

- Marketing investments for new entrants in 2024 could easily exceed tens of millions to achieve basic brand awareness.

- The established supply chains and distribution networks of incumbents like ADENTRA create high barriers to entry.

Government and Regulatory Barriers

While general distribution faces few direct regulatory hurdles, the building materials sector, where ADENTRA operates, is heavily influenced by various building codes, standards, and environmental regulations. These regulatory complexities, which can evolve and increase compliance costs, pose a significant barrier for new entrants. Furthermore, the ongoing potential for trade tariffs, such as those impacting lumber or other imported materials, introduces cost volatility and uncertainty. Established companies like ADENTRA, with their diversified global sourcing strategies, are better equipped to navigate these fluctuating trade policies than less-diversified newcomers.

- Building material regulations require significant compliance investment.

- Environmental standards impose ongoing operational costs.

- Trade tariffs, like those seen in 2024, can increase material costs unpredictably.

- Established supply chains offer resilience against regulatory shifts and tariffs.

The threat of new entrants for ADENTRA is low due to substantial capital requirements for distribution networks and inventory, exemplified by ADENTRA's 86 facilities in 2024. Economies of scale allow ADENTRA to secure favorable supplier pricing, maintaining a cost advantage over newcomers. Established supplier relationships and brand recognition, with ADENTRA reporting $1.5 billion in Q1 2024 net sales, further deter competition. Regulatory complexities and trade tariffs also pose significant barriers, favoring incumbents with diversified supply chains.

| Barrier Type | ADENTRA's Strength | Impact on New Entrants |

|---|---|---|

| Capital Requirements | 86 North American facilities (2024) | High investment, national scale difficult |

| Economies of Scale | Large-volume purchasing power | Higher per-unit costs, price disadvantage |

| Supplier/Brand Loyalty | 2,000+ suppliers, $1.5B Q1 2024 sales | Difficulty replicating ties, building trust |

| Regulatory/Tariff | Diversified global sourcing | Increased compliance costs, volatility |

Porter's Five Forces Analysis Data Sources

Our ADENTRA Porter's Five Forces analysis is built upon a robust foundation of primary and secondary data. This includes ADENTRA's official annual reports, investor presentations, and internal operational data, supplemented by market research reports from reputable firms like Gartner and IDC, and competitor financial filings.

We leverage publicly available information, including trade publications, industry association reports, and macroeconomic data from sources such as the World Bank and national statistical agencies. This ensures a comprehensive understanding of the broader industry landscape and economic factors influencing ADENTRA's competitive environment.