4imprint Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

4imprint Group Bundle

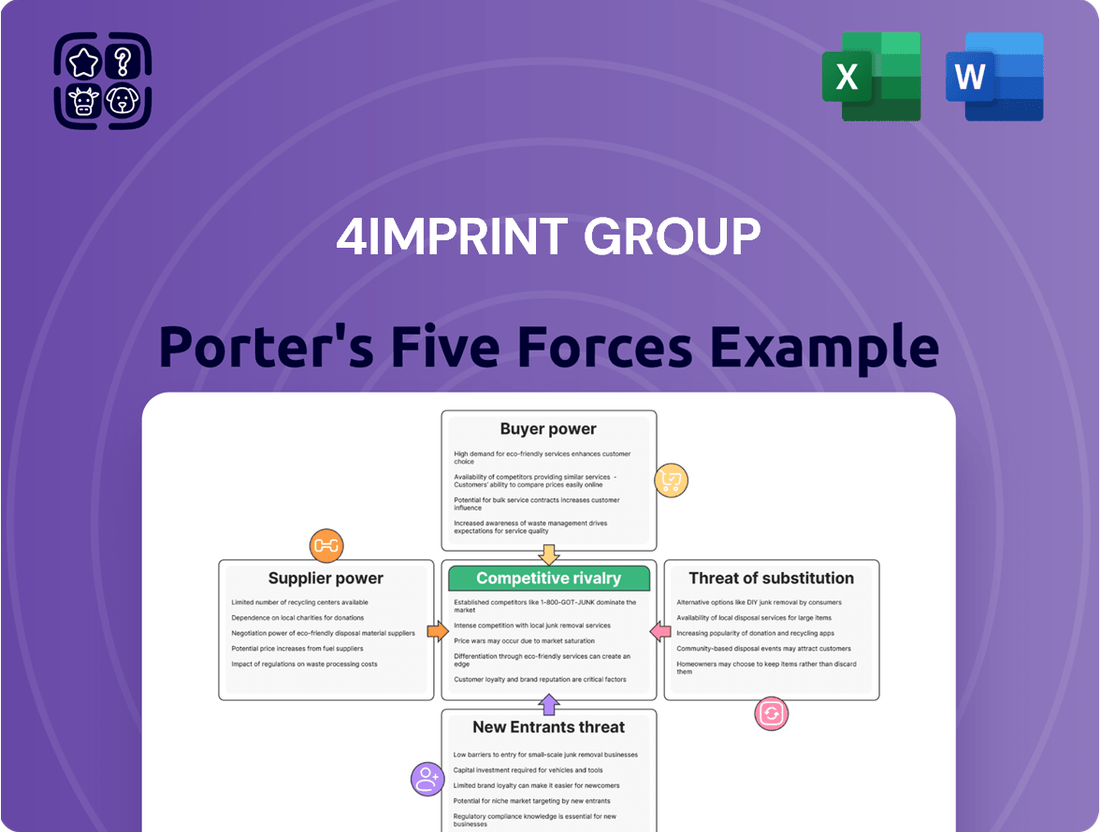

The 4imprint Group operates in a competitive landscape shaped by several key forces. Understanding the bargaining power of buyers and suppliers is crucial, as is assessing the threat of new entrants and the availability of substitute products. The intensity of rivalry within the promotional products industry also significantly impacts 4imprint's strategic positioning and profitability.

The complete report reveals the real forces shaping 4imprint Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in the promotional products industry, which includes items like apparel and drinkware. 4imprint operates within this landscape, sourcing from numerous manufacturers and raw material providers. When suppliers offer standardized goods, 4imprint benefits from increased bargaining power due to the availability of alternatives.

However, the dynamic shifts for specialized products or those requiring unique customization. In these niche areas, where fewer suppliers possess the necessary capabilities, their bargaining power can be considerably higher. This means 4imprint may face more pressure on pricing and terms for these specific product categories.

Switching suppliers for 4imprint would involve tangible costs. These include the time and resources needed to identify and vet new partners, the legal and administrative expenses of negotiating new contracts, and the operational disruption of integrating a new supply chain. These factors collectively create a barrier to easily switching, thereby strengthening the bargaining power of 4imprint's existing suppliers.

4imprint itself acknowledges having established strong supplier relationships, describing them as a real asset, particularly during challenging market conditions. This indicates that while switching is an option, the existing, well-developed relationships likely make it more cumbersome and costly than a simple transactional change. The implied cost of disrupting these relationships further bolsters supplier leverage.

While many promotional products are standard fare, suppliers who can offer distinctive designs, patented materials, or cutting-edge customization techniques hold a stronger negotiating position. For instance, a supplier with a unique eco-friendly fabric or a patented method for embedding microchips into apparel could command higher prices.

4imprint Group's extensive catalog of customizable merchandise suggests it sources from a varied supplier base, likely including both those providing standard, commoditized items and those offering more specialized or proprietary inputs. This diversity in offerings means the bargaining power of suppliers can vary significantly depending on the specific product category.

The company's reliance on a wide array of suppliers for its diverse product range, which includes everything from pens to apparel, means that while individual suppliers might not have overwhelming power, the collective ability of specialized suppliers to influence costs or availability for certain unique items is a factor. For example, a supplier for a highly sought-after, sustainably sourced material might have more leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into 4imprint's direct marketing and distribution of promotional products is a key consideration. If suppliers could readily establish their own robust online platforms and marketing channels, they could directly compete with 4imprint, potentially capturing a larger share of the value chain. This would involve significant investment in IT infrastructure, customer relationship management, and digital marketing expertise.

However, 4imprint's established direct marketing business model, supported by a substantial online presence, presents a considerable barrier. Developing and maintaining a sophisticated e-commerce platform, coupled with efficient customer acquisition strategies and a strong brand reputation in the promotional products industry, requires specialized capabilities. Many suppliers may lack the necessary scale, technical expertise, or marketing resources to effectively replicate 4imprint's operational model.

For instance, 4imprint reported total revenue of $1.37 billion for the year ended December 31, 2023. This scale allows for significant investment in technology and marketing, which would be challenging for smaller suppliers to match. The company’s focus on digital marketing and its extensive customer database are also valuable assets that are difficult for potential new entrants to replicate quickly.

- Suppliers' Forward Integration Threat: Suppliers could enter 4imprint's direct marketing and distribution if they possess the necessary capabilities.

- 4imprint's Competitive Advantages: The company's established direct marketing model, significant online presence, and IT infrastructure create barriers for suppliers.

- Required Supplier Investment: Suppliers would need substantial investment in marketing, IT, and customer acquisition to compete directly.

- Financial Scale: 4imprint's 2023 revenue of $1.37 billion highlights its ability to invest in competitive advantages that are difficult for most suppliers to overcome.

Importance of 4imprint to Supplier Business

As a leading international direct marketer of promotional products, 4imprint's substantial revenue, reaching £1.2 billion in 2023, means it likely represents a significant customer for many of its suppliers. This considerable purchasing volume can grant 4imprint considerable leverage in price and terms negotiations, particularly with smaller or less diversified suppliers who rely heavily on its business.

The bargaining power of suppliers to 4imprint can be analyzed through several lenses:

- Supplier Concentration: If the market for key promotional products is highly concentrated with few dominant suppliers, their collective bargaining power increases.

- Input Differentiation: Suppliers offering unique or highly differentiated products that 4imprint cannot easily source elsewhere will have stronger negotiation positions.

- Switching Costs: For 4imprint, the cost and effort involved in switching to an alternative supplier for specific product lines can influence supplier power.

- Threat of Forward Integration: If suppliers have the potential and inclination to bypass distributors like 4imprint and sell directly to end-customers, their bargaining power is enhanced.

The bargaining power of suppliers for 4imprint Group is generally moderate but can be significant for specialized inputs. 4imprint's scale, evidenced by its 2023 revenue of £1.2 billion, allows it to exert considerable purchasing power with many suppliers, especially those who rely heavily on its business. However, suppliers offering unique or highly differentiated products, such as those with proprietary customization techniques or exclusive materials, can command stronger negotiation positions. The costs and operational disruptions associated with switching suppliers for these specialized items further amplify their leverage.

The threat of suppliers integrating forward into 4imprint's direct marketing and distribution channels is mitigated by 4imprint's established digital infrastructure and customer base. While suppliers could theoretically compete, replicating 4imprint's extensive online presence, IT capabilities, and marketing expertise would require substantial investment, making this threat less immediate for most.

| Factor | Impact on Supplier Bargaining Power | 4imprint Context |

|---|---|---|

| Supplier Concentration | High concentration increases power. | Varies by product; generally diverse base. |

| Input Differentiation | High differentiation increases power. | Key for specialized/customized products. |

| Switching Costs | High costs increase power. | Significant for specialized suppliers. |

| Forward Integration Threat | Potential to bypass distributor increases power. | Barriers exist due to 4imprint's scale and infrastructure. |

What is included in the product

Analyzes the promotional products industry's competitive intensity, buyer and supplier power, threat of new entrants, and substitutes, specifically for 4imprint Group's strategic positioning.

Gain immediate clarity on competitive pressures, empowering swift strategic adjustments to navigate the promotional products landscape.

Customers Bargaining Power

4imprint Group's customer base is incredibly diverse, spread across the globe and encompassing businesses of all sizes, as well as government, educational, and charitable organizations. This wide distribution means no single customer represents a significant portion of their total revenue, a key factor in limiting individual customer bargaining power.

This broad customer dispersion is a strategic advantage for 4imprint. By serving a vast array of clients, they avoid over-reliance on any one entity. This structure inherently dilutes the leverage any single customer could exert, as losing one client, while never ideal, would not materially impact the company's financial health.

For example, in 2024, 4imprint continued to emphasize its strategy of broad market penetration. Their reported revenue streams consistently demonstrate this, with no single customer accounting for more than a minimal percentage of sales, reinforcing the low bargaining power stemming from customer concentration.

Customers in the promotional products sector generally experience low costs when switching between suppliers. Many providers offer comparable customizable items, making it easy for buyers to move.

4imprint actively works to mitigate this by fostering customer trust through its commitment to exceptional service and support. This focus on the customer experience is a key differentiator.

The company's provision of free samples and artwork further enhances customer relationships. While not a direct financial barrier, these offerings can cultivate loyalty and increase the perceived effort to switch.

For instance, in 2023, 4imprint reported a significant increase in customer retention, underscoring the effectiveness of their service-oriented approach in a competitive market. This strategy aims to make the value proposition more compelling than simply price.

Customers possess significant bargaining power when they can easily find alternatives to 4imprint's core offerings. For instance, businesses can opt for digital marketing campaigns, social media advertising, or event sponsorships as substitutes for branded merchandise. This broad array of marketing channels means customers are not solely reliant on promotional products to achieve their brand visibility objectives.

Price Sensitivity of Customers

The promotional products industry is highly fragmented, with numerous suppliers, which naturally increases customer price sensitivity. In such an environment, buyers can easily compare offerings and switch to competitors if prices are not perceived as competitive. This dynamic means that 4imprint must remain acutely aware of pricing benchmarks to maintain its market position.

4imprint actively employs a competitive pricing strategy, emphasizing value for money. This approach involves balancing attractive price points with the assurance of quality products and reliable service. By focusing on this equilibrium, the company aims to not only attract new customers but also foster loyalty among its existing client base.

The company's financial performance in 2024 reflects its ability to navigate this price-sensitive market. For instance, 4imprint reported a strong performance in the first half of 2024, with revenue increasing by 10% compared to the same period in 2023. This growth suggests their value proposition is resonating with customers despite the competitive pricing landscape.

- Customer Price Sensitivity: High due to market fragmentation and numerous competitors.

- 4imprint's Strategy: Competitive pricing and a focus on 'Value for Money'.

- Balancing Act: Maintaining quality and service alongside competitive pricing.

- 2024 Performance Indicator: 10% revenue growth in H1 2024 suggests effective pricing and value delivery.

Customer Information and Transparency

The online nature of 4imprint's operations, along with the broader promotional products industry, significantly enhances customer bargaining power. Customers can readily access and compare pricing, product specifications, and vendor reputations across numerous online platforms. This readily available information empowers them to make informed decisions and negotiate more effectively.

This transparency means customers have a clear understanding of market pricing, reducing the ability of any single supplier like 4imprint to command premium prices without justification. For instance, in 2024, the continued growth of e-commerce in the promotional products sector means that customers can easily obtain multiple quotes within minutes, putting pressure on margins.

- Price Comparison: Customers can effortlessly compare prices from various suppliers of promotional items online.

- Product Availability: Information on product availability and features is widely accessible, allowing for informed choices.

- Vendor Reviews: Online reviews and ratings provide insights into vendor reliability and customer service, influencing purchasing decisions.

- Switching Costs: Low switching costs for customers further amplify their bargaining power, as they can easily move to a competitor offering better terms or value.

Customers' bargaining power is generally low for 4imprint Group due to its highly diversified customer base, which spreads across numerous industries and geographies. This broad distribution means that no single customer accounts for a significant portion of revenue, diminishing individual leverage. For example, in 2024, the company's revenue streams continued to show this wide dispersion, with no single client representing more than a fraction of sales.

Switching costs for customers in the promotional products sector are typically low, as many suppliers offer similar customizable items. However, 4imprint mitigates this by focusing on exceptional customer service and value-added offerings like free samples and artwork, which fosters loyalty. This strategy was evident in 2023 when 4imprint reported increased customer retention, demonstrating the effectiveness of their approach in a competitive market.

The online nature of the industry and 4imprint's operations allows customers to easily compare prices and product offerings. This transparency pressures margins, as buyers can quickly obtain multiple quotes. 4imprint counters this by maintaining competitive pricing and emphasizing value for money, a strategy reflected in its 10% revenue growth in the first half of 2024, indicating successful navigation of price sensitivity.

| Factor | Assessment | 4imprint's Mitigation |

|---|---|---|

| Customer Concentration | Low (Diverse customer base) | Broad market penetration strategy |

| Switching Costs | Low | Focus on service, loyalty programs, value-added services |

| Information Availability | High (Online price comparison) | Competitive pricing, emphasis on value |

| Availability of Substitutes | High (Digital marketing alternatives) | Highlighting benefits of promotional products, customer relationships |

What You See Is What You Get

4imprint Group Porter's Five Forces Analysis

This preview displays the complete 4imprint Group Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, allowing for instant use. You're looking at the actual document; once your transaction is complete, you’ll gain instant access to this same detailed analysis. This is your deliverable, meticulously prepared and ready for your immediate needs without any further customization or setup required.

Rivalry Among Competitors

The promotional products market is characterized by its highly fragmented nature, featuring a vast number of competitors. These range from large, established distributors to smaller, regional, and local suppliers, creating a dynamic and competitive landscape.

While 4imprint holds a prominent position as a leading distributor in North America, the sheer volume of players underscores the intensity of rivalry. This fragmentation means that market share can be hard-won and is constantly under pressure from a diverse set of competitors vying for customer attention and business.

For instance, in 2024, the promotional products industry in the US alone comprises thousands of businesses, many of which are small to medium-sized enterprises. This density of competition forces companies like 4imprint to continually innovate and differentiate their offerings to maintain their market standing.

The promotional products market is seeing steady growth, with U.S. sales projected to hit $27.8 billion by 2025. This upward trend, averaging around 2.8% annually over the last decade, helps to soften the intensity of competitive rivalry. However, even with this market expansion, 4imprint is focused on growing faster than the industry average and increasing its market share.

4imprint Group stands out in the promotional products industry through its strong emphasis on product differentiation. They offer a broad selection of customizable merchandise, allowing clients to tailor products to specific branding needs. This focus on customization is key in a market where many items can easily become commoditized.

The company further differentiates itself by highlighting high-quality products and services, a crucial factor for businesses investing in branded merchandise. Their commitment to quality builds trust and reinforces brand perception for their clients.

Moreover, 4imprint champions an industry-leading customer guarantee, which provides a significant competitive advantage. This guarantee addresses potential customer concerns about product quality and delivery, fostering loyalty and reducing perceived risk.

In 2023, 4imprint reported revenue of $1.16 billion, demonstrating their significant market presence and the effectiveness of their differentiation strategy in attracting and retaining customers in a competitive landscape.

Switching Costs for Customers Among Competitors

Customer switching costs within the promotional products industry are generally low, allowing clients to readily shift their business between different suppliers. This ease of transition fuels intense competition, as companies must continually strive to win and keep customers. For instance, in 2024, many promotional product distributors offer similar online ordering platforms and product catalogs, making it simple for buyers to compare prices and services.

The low switching costs mean that customer loyalty is not deeply entrenched, forcing providers like 4imprint Group to focus heavily on competitive pricing, product innovation, and superior customer service to retain market share. This dynamic directly contributes to the high degree of rivalry observed in the sector.

- Low switching costs empower customers

- Intensified competition for customer acquisition and retention

- Emphasis on price, product, and service to combat churn

- Direct impact on the overall competitive rivalry within the industry

Exit Barriers

Exit barriers for distributors in the promotional products sector are typically not insurmountable. Many products, like custom-printed pens or basic apparel, have low asset specificity, meaning the equipment used can be repurposed or sold relatively easily. This generally keeps exit barriers low for smaller, less specialized players.

However, for a company like 4imprint, which has built a substantial operation, the situation changes. Their significant investments in a robust e-commerce platform, extensive marketing campaigns, and a large, loyal customer base create a more complex exit scenario. These established assets and relationships represent a considerable sunk cost, making a complete withdrawal more challenging.

For instance, in 2023, 4imprint reported revenue of $1.13 billion. Divesting such a large and integrated business would involve navigating the sale of these diverse assets, including intellectual property related to their online ordering systems and established supplier networks. The scale of their operations means that simply ceasing business is unlikely to be the most efficient or financially viable exit route.

The value tied up in their brand recognition and customer data also adds to the exit barriers. Potential acquirers would likely be interested in these intangible assets, but realizing that value requires a structured sale process, rather than a quick liquidation. This complexity elevates the exit barriers beyond those faced by smaller, undifferentiated competitors.

- Low Asset Specificity: Many promotional products require general-purpose equipment, allowing for easier exit for smaller firms.

- Significant Infrastructure Investment: Companies like 4imprint have invested heavily in e-commerce platforms and logistics, increasing exit costs.

- Brand and Customer Loyalty: Established brands and customer relationships represent sunk costs that are difficult to divest quickly.

- Scale of Operations: 4imprint's $1.13 billion in 2023 revenue indicates a large, integrated business that is complex to dismantle or sell.

The promotional products market is highly fragmented, with thousands of competitors, from large distributors to small local suppliers, intensifying rivalry.

While 4imprint is a leader, this broad competitive landscape necessitates continuous innovation and differentiation to maintain market share, especially as many players offer similar online platforms.

Low customer switching costs further fuel this rivalry, pushing companies like 4imprint to prioritize competitive pricing, product innovation, and superior customer service to retain business.

4imprint's strategy of product differentiation, focusing on customization, quality, and a strong customer guarantee, is crucial for standing out in this highly competitive environment.

SSubstitutes Threaten

The threat of substitutes for promotional products is significant, as businesses can leverage a wide array of alternative marketing channels to reach their target audiences. Digital marketing, encompassing social media campaigns, search engine optimization (SEO), and paid advertising, offers cost-effective and highly measurable ways to build brand awareness and drive engagement. In 2024, global digital ad spending was projected to reach over $600 billion, highlighting its prominence.

Beyond digital, traditional advertising avenues like television, radio, and print media continue to play a role, albeit with evolving strategies to capture consumer attention. Furthermore, public relations efforts and strategic sponsorships provide avenues for brand visibility and reputation building without relying solely on tangible promotional items. These diverse alternatives mean that companies may opt to allocate marketing budgets away from physical promotional products.

The threat of substitutes for 4imprint Group's promotional products is influenced by the relative price and performance of alternatives. Digital marketing, for example, can provide highly targeted reach and demonstrable return on investment, often with a lower cost per impression compared to physical promotional items.

However, promotional products offer a unique advantage: tangible, persistent brand visibility. Research indicates that a significant majority, nearly 87%, of people retain promotional products for over a year, ensuring long-term brand recall and engagement that digital campaigns may struggle to match.

The decision to use promotional products instead of other marketing channels hinges on a client's unique goals, budget, and intended audience. While digital marketing is widespread, the tangible nature of promotional items continues to resonate. For instance, a significant 90% of recipients recall a brand after receiving a promotional product, and a compelling 73% are more inclined to engage with that brand in the future.

Evolution of Digital Marketing

The increasing sophistication of digital marketing tools and analytics presents a growing threat of substitutes for traditional promotional methods. Businesses are increasingly able to shift budgets towards online campaigns that offer precise targeting and real-time performance tracking, making them highly competitive alternatives to print advertising or direct mail, which are core to 4imprint's business model.

For instance, the global digital advertising market was projected to reach over $600 billion in 2024, demonstrating a significant and growing investment in these alternative channels. This trend suggests that clients may view digital marketing as a more efficient and measurable way to reach their target audiences compared to physical promotional products.

- Digital Advertising Growth: The digital ad market is expected to surpass $600 billion globally in 2024, highlighting a substantial shift in marketing spend.

- ROI Focus: Digital platforms offer granular data and analytics, allowing businesses to track return on investment (ROI) more effectively than with many physical products.

- Targeting Precision: Advanced digital tools enable hyper-specific audience segmentation, a level of personalization that can be challenging for promotional product companies to match directly.

- Cost-Effectiveness Perception: The perceived cost-effectiveness and measurability of digital campaigns can divert budgets that might otherwise be allocated to branded merchandise.

Shift Towards Experiences Over Tangibles

The increasing consumer preference for experiences over physical goods presents a significant threat of substitutes for companies like 4imprint Group. Some businesses are channeling marketing budgets towards experiential initiatives such as events, sponsorships, and unique customer engagement activities, potentially diverting funds from traditional promotional merchandise. For example, a substantial portion of marketing spend is now allocated to digital experiences and live events, impacting the demand for tangible promotional items.

This shift means that while promotional products can still play a role in enhancing experiences, a purer focus on the experiential aspect can diminish the perceived value and necessity of physical giveaways. Consider the rise of influencer marketing and brand activations that prioritize memorable interactions, potentially reducing the need for branded pens or tote bags. In 2024, the global experiential marketing market is projected to continue its robust growth, indicating a sustained trend away from purely product-centric promotional strategies.

- Experiential Marketing Growth: The global experiential marketing market was valued at approximately $70 billion in 2023 and is expected to see continued expansion through 2024, representing a significant portion of marketing budgets shifting from tangibles.

- Digital Engagement Trends: Increased investment in digital content, virtual events, and personalized online experiences offers alternatives to physical promotional products for brand engagement.

- Brand Activation Focus: Companies are increasingly prioritizing unique brand activations and sponsorships that create memorable customer interactions, potentially reducing reliance on traditional promotional items.

- Measuring ROI: Marketers are focusing on measurable outcomes, and in some cases, the return on investment for experiential campaigns is perceived as more direct than for mass-produced promotional goods.

The threat of substitutes for promotional products is substantial, as businesses can opt for digital marketing, public relations, and sponsorships. Digital channels, projected to exceed $600 billion in global ad spending in 2024, offer measurable reach and engagement. While promotional items provide tangible brand recall, with 90% of recipients recalling a brand after receiving one, the increasing effectiveness and measurability of digital alternatives pose a significant challenge.

Entrants Threaten

While setting up a small promotional product reselling venture might not demand much upfront cash, operating a large-scale direct marketing business akin to 4imprint, which boasts vast product selections, advanced IT infrastructure, and substantial distribution facilities, necessitates considerable capital. For instance, 4imprint allocated $20 million in 2024 towards enhancing its distribution center capacity, illustrating the significant financial commitment required to compete at their level.

Established players like 4imprint have cultivated significant economies of scale in their operations. This means they can produce and distribute goods at a lower per-unit cost due to their large production volumes. For instance, their substantial purchasing power allows for better negotiation on raw materials, and their efficient marketing campaigns reach a wider audience more cost-effectively.

These cost advantages are a major barrier for new entrants. A newcomer would find it incredibly difficult to achieve the same level of cost efficiency. Without matching 4imprint's scale, new companies would likely have higher production costs, making it challenging to compete on price or offer the same breadth of products.

In 2023, 4imprint reported net revenue of $1.14 billion, showcasing the sheer volume of their operations. This scale allows them to absorb fixed costs over a much larger revenue base, further solidifying their pricing advantage and making it tough for smaller, newer competitors to enter and gain market share.

For 4imprint Group, the threat of new entrants is significantly shaped by access to effective distribution channels. Their direct marketing model thrives on a robust online platform and an efficient drop-ship distribution network, developed over many years. New competitors would need to replicate this or secure comparable channels to reach customers effectively. In 2024, the continued growth of e-commerce means established logistics networks are a major barrier.

Brand Loyalty and Customer Acquisition Costs

The promotional products industry is highly fragmented, making it challenging for new players to gain traction. 4imprint benefits from a long tradition of excellence in customer service, cultivating a growing customer file. This established customer base and reputation act as significant barriers to entry.

New entrants face substantial costs and time investments in acquiring customers and fostering brand loyalty within this competitive landscape. For instance, in 2023, 4imprint's marketing and selling expenses were $161.2 million. This figure highlights the significant investment required to reach and retain customers, a hurdle that startups must overcome.

- Brand Loyalty: 4imprint's established reputation and focus on customer service foster strong brand loyalty, making it difficult for new entrants to attract and retain customers.

- Customer Acquisition Costs: The cost of acquiring new customers in the promotional products sector is high, requiring significant marketing and sales investment, which can deter new entrants.

- Fragmented Market: While fragmented, the market still demands considerable resources to build brand awareness and market share against established players like 4imprint.

- Growing Customer File: 4imprint's expanding customer database provides a significant advantage, offering repeat business and a foundation for cross-selling opportunities that new entrants lack.

Regulatory Hurdles and Product Safety Standards

While not insurmountable, regulatory hurdles and product safety standards present a moderate threat to new entrants in the promotional products industry, impacting companies like 4imprint Group. Adhering to these regulations requires investment and expertise, potentially slowing down market entry.

Key barriers include:

- Product Safety Compliance: Ensuring all promotional items meet safety standards, especially for items intended for children or those with electronic components, demands rigorous testing and certification processes.

- Intellectual Property Rights: Protecting the intellectual property of branded merchandise, including logos and designs, is crucial. New entrants must navigate trademark laws to avoid infringement, adding legal and administrative costs.

- International Trade Regulations: For a global player like 4imprint, understanding and complying with varying international trade regulations, including tariffs and import/export laws in different markets, is essential. For instance, in 2024, the global supply chain continued to grapple with trade policy shifts impacting the cost and availability of goods.

The threat of new entrants for 4imprint Group is moderate, primarily due to the significant capital investment required for large-scale operations and established distribution networks. While the promotional products market can appear accessible, replicating 4imprint's economies of scale, brand loyalty, and customer acquisition capabilities presents substantial challenges for newcomers. In 2023, 4imprint's marketing and selling expenses alone amounted to $161.2 million, illustrating the financial commitment needed to compete effectively.

| Barrier | Description | Impact on New Entrants | Relevant 4imprint Data (2023/2024) |

| Capital Requirements | High investment needed for infrastructure, inventory, and marketing. | Deters many potential entrants. | $20 million allocated to distribution capacity enhancement in 2024. |

| Economies of Scale | Lower per-unit costs due to large-scale purchasing and operations. | Makes it difficult for new entrants to compete on price. | $1.14 billion in net revenue in 2023 indicates significant operational scale. |

| Brand Loyalty & Customer Base | Established reputation and a large, loyal customer file. | High customer acquisition costs and difficulty in attracting customers away from 4imprint. | Marketing and selling expenses of $161.2 million in 2023. |

| Distribution Channels | Well-developed direct marketing and drop-ship capabilities. | Requires substantial investment to build comparable logistics. | Continued growth of e-commerce in 2024 emphasizes the value of established networks. |

Porter's Five Forces Analysis Data Sources

Our 4imprint Group Porter's Five Forces analysis leverages a comprehensive suite of data sources, including 4imprint's annual reports, SEC filings, and industry-specific market research from firms like IBISWorld and Statista. This ensures a robust understanding of competitive dynamics within the promotional products industry.