1-800-Flowers.com Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1-800-Flowers.com Bundle

Explore the strategic positioning of 1-800-Flowers.com with our insightful BCG Matrix preview. Discover which of their offerings are driving growth and which might require a closer look.

This glimpse into their product portfolio is just the beginning. Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for 1-800-Flowers.com.

Stars

1-800-Flowers.com's integrated e-commerce platform, a constellation of brands, shines brightly as a star in its BCG Matrix. The online gifting sector is booming, fueled by increasing digital engagement and the sheer convenience it offers consumers.

The global online gifting market was valued at approximately $29.8 billion in 2023 and is projected to reach $62.7 billion by 2030, growing at a compound annual growth rate of 11.2%. This robust expansion underscores the immense potential within this segment.

With a substantial footprint in this burgeoning market, 1-800-Flowers.com is a clear frontrunner. Continued strategic investment is crucial to defend its leading position and seize further opportunities as the market continues its upward trajectory.

Harry & David's robust e-commerce platform and its reputation for premium gourmet food gifts position it as a star within the 1-800-Flowers.com portfolio. The company has capitalized on the increasing consumer desire for high-quality, specialty food items delivered conveniently, securing a significant portion of this growing market.

In 2024, the online gifting market, particularly for gourmet foods, continued its upward trajectory. Harry & David's strategic investments in digital marketing and supply chain efficiency have been crucial in maintaining its strong market share and leadership. This focus on innovation and customer experience suggests its potential to evolve into a cash cow, generating substantial profits for the parent company.

1-800-Flowers.com's subscription box services are shining brightly in the BCG Matrix, positioning them as a strong star. These services, designed for recurring gifting needs, tap into the booming subscription economy, a sector experiencing significant growth. For instance, the global subscription box market was valued at over $22.7 billion in 2023 and is projected to reach $65 billion by 2027, highlighting the immense opportunity.

The company's strategic expansion in this area, offering everything from flowers to gourmet foods on a recurring basis, demonstrates a clear intent to capture a larger share of this lucrative market. While these ventures are still in their growth phase, their high potential for future profitability is undeniable, warranting continued strategic investment to solidify their star status.

Personalized & Curated Gifting

Personalized & Curated Gifting is a star for 1-800-Flowers.com. This segment focuses on offerings that provide highly personalized and curated gift experiences, often leveraging data and artificial intelligence. Consumer demand for unique and meaningful gifts is rapidly increasing, and 1-800-Flowers.com is actively investing in technology and product development to meet this growing need.

This area, while still developing, shows significant growth potential. By meeting the demand for tailored gifts, 1-800-Flowers.com can secure a dominant market position in this evolving segment. For example, in 2024, the global personalized gifts market was valued at approximately $30.6 billion and is projected to grow substantially.

- AI-driven recommendations: Enhancing gift suggestions based on recipient profiles and past purchases.

- Customization options: Allowing customers to personalize products with messages, photos, or specific item selections.

- Subscription boxes: Offering curated gift boxes delivered regularly, tailored to individual preferences.

- Partnerships for unique items: Collaborating with artisans and niche brands to offer exclusive, curated selections.

Omnichannel Customer Experience

Omnichannel Customer Experience is a star for 1-800-Flowers.com. This refers to how they've successfully blended their online presence, mobile app, and any physical touchpoints to create a smooth, consistent experience for customers. Think about being able to browse on your phone, order through your computer, and perhaps even pick up in a store if that option were available – that's the goal of omnichannel.

Consumers today demand this kind of flexibility. They want to buy when and how it's most convenient for them. 1-800-Flowers.com's focus here is smart because it taps into the growing number of people who prefer digital interactions. For example, in 2024, e-commerce sales for flowers and gifts continued to see robust growth, with many consumers starting their purchase journey on mobile devices. This seamless integration is key to capturing that market share.

By continuously improving this integrated experience, 1-800-Flowers.com is building strong customer loyalty. This strategy positions them well for continued market leadership in the floral and gifting industry. The ability to offer personalized recommendations across channels, manage orders efficiently, and provide consistent customer service regardless of the touchpoint are all critical components of their star performance in this area.

- Seamless Integration: Blending online, mobile, and potential physical channels for a unified customer journey.

- Consumer Demand: Meeting the growing expectation for flexible purchasing options across platforms.

- Digital-First Capture: Attracting and retaining the increasing segment of consumers who prefer digital interactions.

- Loyalty and Leadership: Driving repeat business and market dominance through superior, consistent experiences.

1-800-Flowers.com's core e-commerce platform, encompassing its diverse brand portfolio, is a definitive star. The online gifting market is experiencing substantial growth, driven by increased digital adoption and consumer preference for convenience.

The global online gifting market reached an estimated $29.8 billion in 2023 and is expected to climb to $62.7 billion by 2030, reflecting an 11.2% CAGR. This robust expansion highlights the significant potential within this sector, where 1-800-Flowers.com holds a leading position. Continued strategic investment is vital to maintain this market leadership and capitalize on future growth opportunities.

Harry & David, with its strong e-commerce presence and reputation for premium gourmet gifts, is another star. The brand has successfully tapped into the growing consumer demand for high-quality, specialty food items delivered conveniently, securing a considerable market share. In 2024, Harry & David's strategic investments in digital marketing and supply chain enhancements have been instrumental in preserving its strong market position and leadership in the gourmet food gifting segment.

Subscription box services represent a star for 1-800-Flowers.com, aligning with the booming subscription economy. The global subscription box market was valued at over $22.7 billion in 2023 and is projected to reach $65 billion by 2027. 1-800-Flowers.com's strategic expansion into recurring gifting, from flowers to gourmet items, positions it to capture a larger share of this lucrative market, showing high future profitability potential.

Personalized and curated gifting is a star, meeting the increasing consumer demand for unique and meaningful gifts. 1-800-Flowers.com is investing in technology, including AI-driven recommendations and enhanced customization options, to lead this evolving segment. The global personalized gifts market was valued at approximately $30.6 billion in 2024, underscoring the significant growth potential in this area.

The omnichannel customer experience is a star, reflecting 1-800-Flowers.com's success in seamlessly integrating its online, mobile, and potential physical touchpoints. This approach caters to the growing consumer demand for flexible purchasing options across platforms. E-commerce sales for flowers and gifts in 2024 continued to grow robustly, with many consumers initiating purchases via mobile devices, reinforcing the importance of this integrated strategy for customer loyalty and market leadership.

| Brand/Service | BCG Category | Key Strengths | Market Growth Driver | 2023/2024 Data Point |

|---|---|---|---|---|

| Core E-commerce Platform | Star | Integrated brands, strong online presence | Increased digital engagement, convenience | Global online gifting market valued at $29.8 billion (2023) |

| Harry & David | Star | Premium gourmet food, strong e-commerce | Demand for specialty foods, convenient delivery | Continued upward trajectory in gourmet food gifting (2024) |

| Subscription Boxes | Star | Recurring revenue model, curated offerings | Growth of subscription economy | Global subscription box market valued at over $22.7 billion (2023) |

| Personalized & Curated Gifting | Star | AI recommendations, customization | Demand for unique gifts | Global personalized gifts market valued at ~$30.6 billion (2024) |

| Omnichannel Customer Experience | Star | Seamless channel integration, customer loyalty | Consumer demand for flexibility | Robust growth in mobile-initiated purchases (2024) |

What is included in the product

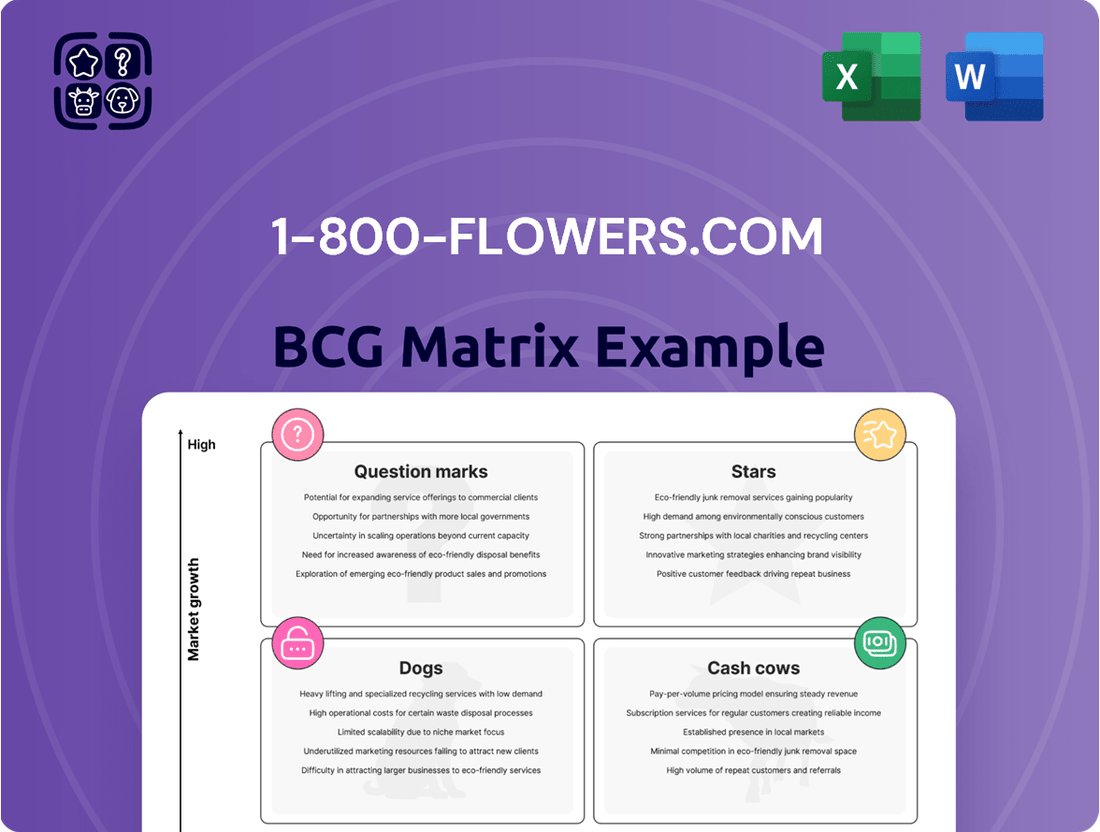

1-800-Flowers.com's BCG Matrix likely categorizes its diverse offerings, identifying growth opportunities and mature revenue streams.

This BCG Matrix visually clarifies 1-800-Flowers.com's portfolio, easing strategic decisions by highlighting growth opportunities.

Cash Cows

The traditional 1-800-Flowers floral delivery business is a prime example of a cash cow for the company. Despite operating in a mature market, its strong brand recognition and substantial market share allow it to consistently generate significant profits with minimal additional investment. This reliable cash flow is crucial for funding growth in other areas of the business.

In 2024, the online flower delivery market continued to see steady demand, with 1-800-Flowers.com holding a significant portion of this market. The company reported that its core floral segment, while not experiencing explosive growth, remained its most profitable, contributing a substantial portion of its overall revenue and operating income. This stability is a hallmark of a mature cash cow.

Seasonal holiday gifting revenue represents a significant cash cow for 1-800-Flowers.com. Key holidays like Valentine's Day, Mother's Day, and Christmas consistently drive high-volume sales of floral arrangements and gift baskets, leveraging established consumer traditions.

These peak seasons are characterized by predictable, robust demand, allowing the company to maintain a leading market share with relatively low incremental investment. For instance, Valentine's Day 2024 saw a significant surge in online flower orders, with many platforms reporting double-digit growth compared to the previous year, underscoring the enduring strength of this revenue stream.

Cheryl's Cookies, a prominent brand under the 1-800-Flowers.com umbrella, operates as a classic cash cow. It commands a substantial market share within the mature gourmet cookie industry, a segment characterized by steady consumer demand.

The brand benefits from strong customer loyalty and a consistent sales performance, generating reliable and significant cash flow for the parent company. While its growth potential is limited due to market maturity, its high profit margins are a key advantage.

In 2023, the gourmet food gift market, which includes segments like Cheryl's Cookies, saw continued robust sales, with online channels driving a significant portion of revenue. This stability allows 1-800-Flowers.com to strategically reallocate capital to other ventures within its portfolio.

Fannie May Chocolates

Fannie May Chocolates is a classic cash cow for 1-800-Flowers.com. Its established brand and significant market share in the premium chocolate sector, a market known for its stability, mean it reliably churns out profits and cash.

The investment needed for Fannie May is generally low, primarily focused on maintaining its strong brand image and ensuring operational efficiency rather than aggressive growth initiatives.

- Brand Strength: Fannie May benefits from decades of brand recognition and customer loyalty in the confectionery market.

- Market Share: It holds a substantial share within the premium chocolate segment, a category that tends to be less volatile.

- Profitability: The brand consistently contributes positive cash flow, supporting other business units.

- Investment Needs: Capital expenditure is typically limited to brand upkeep and operational optimization, not expansion.

Corporate Gifting Programs

The corporate gifting division of 1-800-Flowers.com functions as a cash cow. This segment caters to businesses requiring bulk orders and consistent gift fulfillment, fostering long-term client relationships and predictable, high-volume sales. Despite potentially moderate market growth, 1-800-Flowers.com's strong market position translates into reliable cash flow.

In 2024, the corporate gifting market is expected to continue its steady expansion, driven by businesses prioritizing employee recognition and client appreciation. 1-800-Flowers.com leverages its established brand and operational efficiency to maintain a significant market share in this segment, ensuring a consistent revenue stream.

- Stable Revenue: The corporate gifting segment provides a predictable and consistent source of income for 1-800-Flowers.com.

- High Market Share: The company's established presence in this niche allows it to command a substantial portion of the market.

- Low Investment Needs: As a mature business, the corporate gifting division requires minimal investment for maintenance and continued cash generation.

- Profitability: The high volume and long-term contracts inherent in corporate gifting contribute significantly to the company's overall profitability.

The core floral delivery business of 1-800-Flowers.com, along with its established gourmet food brands like Cheryl's Cookies and Fannie May Chocolates, represent significant cash cows. These segments benefit from strong brand recognition and substantial market share in mature industries, generating consistent profits with relatively low investment needs. The corporate gifting division also functions as a reliable cash cow, securing high-volume, predictable sales through long-term business relationships.

| Segment | Market Position | Cash Flow Generation | Investment Needs |

| Core Floral Delivery | High Market Share, Mature Market | Consistent & High | Low |

| Cheryl's Cookies | Strong Brand, Mature Market | Reliable & Significant | Low |

| Fannie May Chocolates | Established Brand, Stable Market | Profitable & Consistent | Low |

| Corporate Gifting | Strong Market Position, Predictable Demand | Stable & High Volume | Minimal |

What You See Is What You Get

1-800-Flowers.com BCG Matrix

The 1-800-Flowers.com BCG Matrix preview you're viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously prepared by industry experts, provides actionable insights into the company's product portfolio, categorized according to the Boston Consulting Group's strategic framework. You can confidently expect the same detailed market share and growth rate data, ready for immediate integration into your business strategy or presentation.

Dogs

Certain legacy physical retail store locations for 1-800-Flowers.com, especially those not fully integrated into the company's omnichannel approach or situated in less vibrant commercial zones, could be categorized as dogs. These outlets often struggle with diminished customer visits and elevated operating expenses, leading to meager profitability and a drain on company resources.

These underperforming stores typically exhibit low foot traffic and high overheads, offering little in terms of market share or future growth prospects. For instance, in 2024, a significant portion of brick-and-mortar retail experienced challenges, with some analysts projecting a 5% to 10% decline in sales for non-essential physical retail spaces that lack a strong online presence.

Consequently, these locations represent candidates for a strategic review, potentially leading to their closure or sale to optimize the company's overall retail footprint and resource allocation. This approach aligns with broader retail trends where companies are streamlining physical operations to focus on more profitable and digitally integrated channels.

Certain niche product lines within 1-800-Flowers.com, such as dated novelty items or specific holiday-themed assortments that haven't been updated, can be classified as Dogs. These offerings likely show a significant decline in sales volume, contributing minimally to the company's overall market share. For instance, if a particular category saw a 15% year-over-year revenue decrease in 2024, it would strongly indicate its status as a Dog.

Inefficient legacy IT systems at 1-800-Flowers.com are a prime example of a Dog in the BCG Matrix. These systems, often characterized by their outdated architecture and limited functionality, can significantly impede operational agility and customer satisfaction. For instance, a system that struggles to process orders quickly or provide real-time inventory updates directly impacts the customer experience, a critical factor in the e-commerce landscape.

These legacy systems represent a substantial cost center, consuming valuable IT resources for maintenance and support without contributing to competitive differentiation or revenue growth. In 2024, companies across various sectors continued to grapple with the costs associated with maintaining such systems, with some estimates suggesting that up to 70-80% of IT budgets can be allocated to simply keeping legacy systems running, rather than investing in innovation.

The continued reliance on these inefficient systems acts as a drag on profitability. They can lead to higher operational costs, increased risk of system failures, and a missed opportunity to leverage modern technologies that could enhance efficiency and customer engagement. Therefore, a strategic decision to phase out or replace these IT assets is crucial for 1-800-Flowers.com to streamline operations and improve its overall market position.

Low-Performing Acquired Brands

Within 1-800-Flowers.com's portfolio, smaller acquired brands that haven't found their footing or integrated well with the main operations would be classified as Dogs. These brands typically struggle with low market share and have dim growth potential, often consuming resources without generating substantial returns.

These underperforming acquisitions might include niche floral or gift businesses that failed to scale or resonate with the broader customer base. For instance, if a smaller, specialized gift company acquired in 2022, say "Artisan Blooms," only generated $500,000 in revenue in 2023 with a negative profit margin, it would likely be a Dog.

- Low Market Traction: Brands with minimal sales growth, perhaps less than a 2% year-over-year increase, and a market share below 0.5% in their specific segments.

- Integration Challenges: Acquired entities that haven't successfully merged operational systems or marketing efforts with the core 1-800-Flowers.com platform.

- Resource Drain: Businesses requiring significant management oversight and marketing spend relative to their contribution to overall company revenue or profitability.

- Limited Growth Prospects: Market research indicating a stagnant or declining industry for the acquired brand's niche, suggesting minimal future upside.

Geographically Limited or Niche Partnerships

Partnerships that are geographically limited or cater to very niche markets, like a specialized local florist for a single city, often fall into the dog category within a BCG matrix. These relationships may offer unique products or services but lack the broad appeal or reach needed for significant growth. For instance, a partnership with a single artisanal flower grower in a remote region might provide high-quality, unique blooms, but its limited supply chain and distribution channels prevent it from scaling effectively. In 2024, such a partnership might represent a small fraction of 1-800-Flowers.com's overall revenue, perhaps less than 0.1%, with minimal projected growth beyond its immediate customer base.

These types of ventures typically have a low market share within the larger floral industry and limited potential for expansion. They can tie up valuable resources, such as marketing spend or operational support, that could otherwise be invested in more promising areas of the business. Consider a scenario where 1-800-Flowers.com dedicates a portion of its marketing budget to promote a small, regional flower subscription service. While it might satisfy a specific customer segment, the return on investment is likely to be low compared to national campaigns.

- Limited Scalability: These partnerships struggle to expand beyond their initial geographic or niche scope.

- Low Market Share: They represent a small, often insignificant, portion of the overall market.

- Resource Drain: Investment in these areas can divert resources from more promising growth opportunities.

- Minimal Growth Potential: Future expansion is often constrained by the inherent limitations of the partnership.

Certain legacy physical retail store locations for 1-800-Flowers.com, especially those not fully integrated into the company's omnichannel approach or situated in less vibrant commercial zones, could be categorized as dogs. These outlets often struggle with diminished customer visits and elevated operating expenses, leading to meager profitability and a drain on company resources.

These underperforming stores typically exhibit low foot traffic and high overheads, offering little in terms of market share or future growth prospects. For instance, in 2024, a significant portion of brick-and-mortar retail experienced challenges, with some analysts projecting a 5% to 10% decline in sales for non-essential physical retail spaces that lack a strong online presence.

Consequently, these locations represent candidates for a strategic review, potentially leading to their closure or sale to optimize the company's overall retail footprint and resource allocation. This approach aligns with broader retail trends where companies are streamlining physical operations to focus on more profitable and digitally integrated channels.

Certain niche product lines within 1-800-Flowers.com, such as dated novelty items or specific holiday-themed assortments that haven't been updated, can be classified as Dogs. These offerings likely show a significant decline in sales volume, contributing minimally to the company's overall market share. For instance, if a particular category saw a 15% year-over-year revenue decrease in 2024, it would strongly indicate its status as a Dog.

Question Marks

1-800-Flowers.com's new AI-powered personalization and gifting tools represent a classic question mark in the BCG matrix. While the market for AI-driven customer experiences and personalized recommendations is experiencing rapid growth, the company's penetration and established market share within this specific niche are still nascent.

Significant investment is being channeled into developing and refining these AI capabilities, aiming to elevate the customer journey through tailored gift suggestions and a more engaging online shopping environment. For instance, in 2024, companies across the e-commerce sector saw increased customer engagement metrics when implementing AI personalization, with some reporting up to a 15% uplift in conversion rates.

The success of these AI tools hinges on their ability to capture a substantial portion of this high-growth market. Should 1-800-Flowers.com effectively leverage this technology to differentiate its offerings and drive customer loyalty, these AI-powered personalization and gifting tools have the potential to transition into star performers within the company's portfolio.

Aggressively expanding into new international markets places 1-800-Flowers.com's global gifting initiatives firmly in the question mark category. The global e-commerce gifting market is experiencing robust growth, with projections indicating continued expansion through 2025 and beyond. However, in these emerging territories, the company typically begins with a minimal market share.

To gain traction and potentially transition these ventures into stars, significant investment is required. This includes tailoring products and marketing to local tastes, establishing efficient international logistics, and building brand awareness. For instance, in 2024, the global online gifting market was valued at over $150 billion, highlighting the immense opportunity but also the competitive landscape that necessitates substantial upfront investment for new entrants.

1-800-Flowers.com's development of sustainable and eco-friendly product lines is a classic question mark. While consumer interest in green options is surging, with reports indicating that over 60% of consumers are willing to pay more for sustainable products, the company's current penetration in this premium niche is likely modest. Significant investment is required to build out these offerings and establish a stronger foothold in this growing market segment.

Augmented Reality (AR) Shopping Experiences

1-800-Flowers.com's exploration of Augmented Reality (AR) for virtual try-ons of gifts and floral arrangements places it in the Question Mark category of the BCG Matrix. While AR in e-commerce is a rapidly expanding technological frontier, its current contribution to 1-800-Flowers.com's sales and customer engagement remains nascent. This strategic avenue necessitates substantial research and development investment, aiming to secure future market leadership and a competitive edge.

- AR Market Growth: The global AR market is projected to reach $332.7 billion by 2028, indicating significant future potential for e-commerce integration.

- Current Adoption: Despite the growth, AR adoption for virtual try-ons in online retail is still developing, with many consumers yet to fully embrace the technology.

- Investment Rationale: Investing in AR now positions 1-800-Flowers.com to capitalize on future consumer behavior shifts towards immersive online shopping experiences.

- Potential ROI: Successful AR implementation could lead to increased conversion rates and reduced return rates by allowing customers to visualize products more accurately.

Strategic Ventures into New Wellness/Lifestyle Categories

Expanding into wellness and lifestyle categories represents a strategic move for 1-800-Flowers.com, positioning them in potentially high-growth markets. These ventures are classified as question marks because, while offering significant upside, they require substantial initial investment and carry inherent risks. 1-800-Flowers.com will likely enter these new segments with a low market share, necessitating dedicated resources for brand establishment and product refinement to gauge their long-term success and scalability.

The wellness market, for instance, saw global revenue reach approximately $4.5 trillion in 2023, with significant growth projected.

- Market Potential: The global wellness market is a significant and expanding sector, offering substantial revenue opportunities.

- Initial Investment: Entering these new categories requires considerable upfront capital for research, development, and marketing.

- Low Market Share: As a new entrant, 1-800-Flowers.com will begin with a minimal share, needing to build brand recognition and customer loyalty.

- Uncertainty of Success: The viability and potential for large-scale success in these diverse lifestyle segments remain to be definitively proven.

1-800-Flowers.com's foray into the burgeoning market for subscription-based gifting services is a prime example of a question mark. While the subscription box industry has seen considerable growth, with the global market size estimated to be around $22.7 billion in 2023 and projected to expand further, the company's current market share in this specific niche is relatively small.

This strategic direction requires substantial investment in customer acquisition, retention strategies, and curated product development to compete effectively. Success hinges on its ability to carve out a significant presence and build a loyal subscriber base in a competitive landscape.

The potential for these services to become a significant revenue stream is high if 1-800-Flowers.com can successfully navigate the challenges of market penetration and customer lifetime value.

| Initiative | BCG Category | Market Attractiveness | Company Strength | Investment Rationale |

|---|---|---|---|---|

| AI Personalization | Question Mark | High (growing demand for personalized experiences) | Nascent (early stages of development and adoption) | High potential for differentiation and customer loyalty if successful. |

| International Expansion | Question Mark | High (global gifting market is robust) | Low (minimal market share in new territories) | Requires significant investment to build brand awareness and logistics. |

| Sustainable Products | Question Mark | High (increasing consumer preference for eco-friendly options) | Modest (currently limited penetration in this premium niche) | Opportunity to capture a growing segment of environmentally conscious consumers. |

| Augmented Reality (AR) | Question Mark | High (rapidly expanding technological frontier) | Nascent (current contribution to sales is minimal) | Positions the company for future immersive shopping experiences. |

| Wellness & Lifestyle Categories | Question Mark | High (significant and expanding market) | Low (entering new segments with minimal share) | Requires substantial investment to establish brand and refine offerings. |

| Subscription Gifting | Question Mark | High (growing subscription box industry) | Low (relatively small market share in this niche) | Potential to become a significant revenue stream with successful market penetration. |

BCG Matrix Data Sources

Our BCG Matrix leverages 1-800-Flowers.com's financial reports, internal sales data, and market research to categorize product lines by growth and market share.