10X Genomics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

10X Genomics Bundle

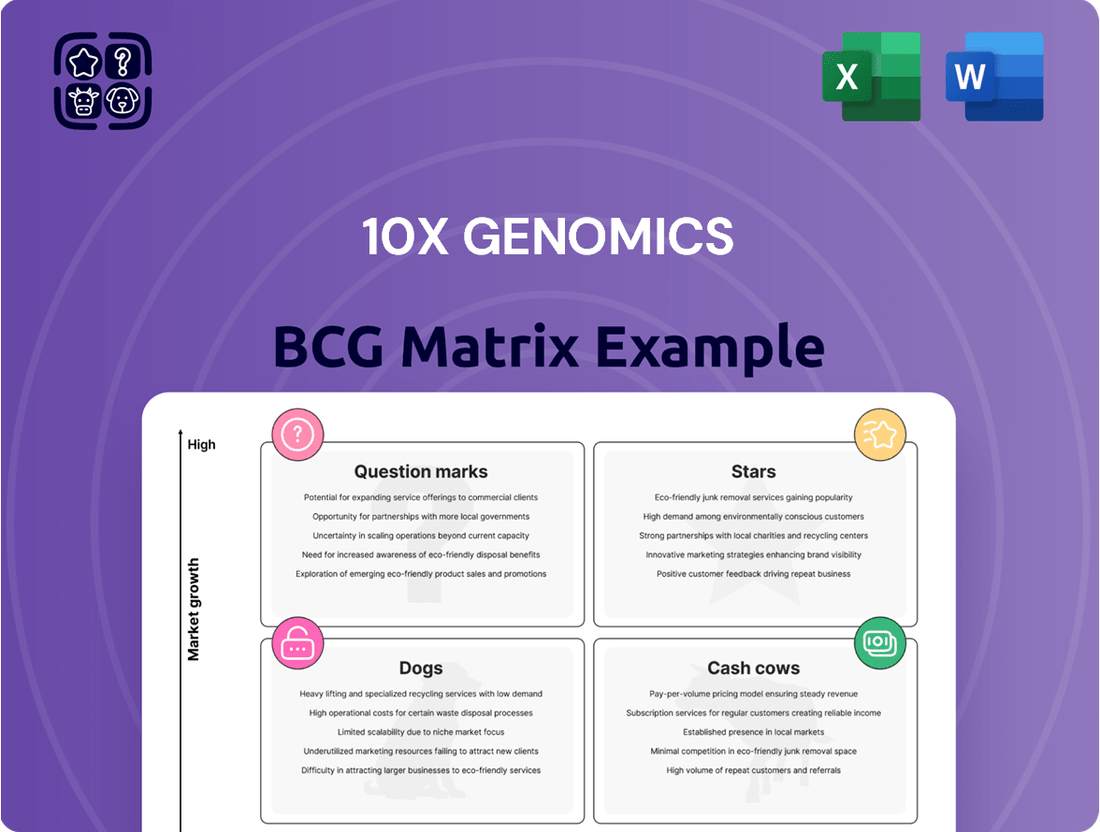

Understand 10X Genomics' current product portfolio by seeing where their innovations fall on the BCG Matrix – are they market-leading Stars, reliable Cash Cows, underperforming Dogs, or promising Question Marks? This glimpse into their strategic positioning is just the start.

Unlock the full potential of this analysis by purchasing the complete 10X Genomics BCG Matrix. Gain detailed quadrant placements, actionable insights, and a clear roadmap to optimize your investments and product strategy.

Don't miss out on the complete picture. Get the full BCG Matrix report for a comprehensive breakdown and strategic recommendations that will empower your decision-making.

Stars

The Chromium Single Cell Platform consumables from 10X Genomics are a prime example of a Star in the BCG Matrix. This segment operates within the rapidly expanding single-cell analysis market, a critical area for life science research and development.

Despite a dip in instrument sales, the demand for Chromium consumables remains robust, driven by a loyal and growing customer base. This sustained demand translates into a consistent and reliable revenue stream, underscoring the platform's market dominance.

In 2024, 10X Genomics reported strong performance in its life sciences segment, with single-cell solutions being a significant contributor. The company's focus on consumables for its Chromium platform ensures continued engagement and revenue generation from its installed base, reinforcing its Star status in a high-growth sector.

The Visium Spatial Gene Expression Solution, particularly with the introduction of Visium HD in 2024, solidifies 10x Genomics' dominant position in the burgeoning spatial biology sector. This advanced technology offers unprecedented resolution and versatility, supporting a wide array of tissue preparations including FFPE, fresh frozen, and fixed frozen samples.

This broad compatibility fuels robust customer adoption and consistently drives consumable revenue growth, underscoring Visium's substantial market share within a high-growth industry. The company reported that spatial biology solutions, largely driven by Visium, represented a significant portion of its revenue in early 2024, with analysts projecting continued double-digit growth for this segment throughout the year.

Xenium In Situ Analysis, a key offering from 10x Genomics, is positioned strongly within the rapidly expanding spatial biology sector. Its ability to map RNA at a subcellular level, with ongoing expansion into protein analysis, places it at the forefront of innovation.

Despite potential initial challenges in instrument sales, the market is showing increasing adoption. This is driven by the optimization of per-sample costs, notably through techniques like tumor microarrays, indicating a growing market share in a dynamic and high-potential field.

Future Multiomic Solutions

10x Genomics is heavily investing in its future multiomic solutions, a key driver for its position in the BCG matrix. Their innovation roadmap includes integrating RNA and protein detection on the same slide for the Xenium platform. This advancement is expected to significantly enhance the depth of biological insights researchers can obtain.

Further expanding capabilities within their established Chromium and Visium platforms, 10x Genomics is solidifying its offerings. These ongoing developments are designed to address increasingly complex biological questions, positioning these multiomic solutions as potential stars for future market growth and a significant competitive advantage.

The company's commitment to innovation is evident in its strategic focus on these integrated multiomic approaches. For instance, by combining spatial transcriptomics with protein analysis, 10x Genomics aims to provide a more comprehensive understanding of cellular environments. This move is crucial for tackling intricate research areas such as cancer biology and neuroscience.

- Xenium Platform Enhancements: Integration of RNA and protein detection on a single slide.

- Chromium and Visium Expansion: Continued development to broaden analytical capabilities.

- Unlocking Deeper Insights: Enabling researchers to address more complex biological questions.

- Future Market Growth: Positioning multiomic solutions as key drivers for competitive advantage and revenue.

Strategic Partnerships and Collaborations

Strategic partnerships are a cornerstone of 10x Genomics' growth strategy, allowing them to expand their technological reach and data generation capabilities. Collaborations like the one with Arc Institute for the Virtual Cell Atlas and the Billion Cells Project, involving the Chan Zuckerberg Initiative and Ultima Genomics, highlight this commitment. These alliances are crucial for advancing AI model development and solidifying 10x Genomics' leadership in the rapidly evolving genomics landscape.

These strategic alliances not only accelerate innovation but also drive the adoption of 10x Genomics' platforms in high-impact research areas. By partnering with leading institutions and companies, 10x Genomics can tap into new datasets and expertise, further enhancing the value proposition of their single-cell and spatial genomics solutions. This proactive approach to collaboration is key to maintaining a significant market share.

- Partnership with Arc Institute for Virtual Cell Atlas

- Billion Cells Project with Chan Zuckerberg Initiative and Ultima Genomics

- Expansion of data generation and AI model development

- Strengthening market leadership and technology adoption

The Chromium Single Cell Platform consumables and the Visium Spatial Gene Expression Solution, especially with the 2024 introduction of Visium HD, are clear Stars for 10x Genomics. These offerings dominate high-growth markets in single-cell and spatial biology, respectively.

In 2024, 10x Genomics saw significant revenue contributions from its life sciences segment, with single-cell and spatial solutions leading the charge. The company's installed base for these platforms ensures consistent consumable revenue, reinforcing their Star status.

The Xenium In Situ Analysis platform, with its advanced subcellular RNA mapping and expanding protein analysis capabilities, is also a Star. Despite initial instrument adoption curves, optimized per-sample costs are driving market share in this dynamic field.

10x Genomics' strategic investments in multiomic solutions, integrating RNA and protein detection on platforms like Xenium, further solidify their Star position. These advancements are poised to capture future market growth by addressing increasingly complex biological questions.

| Product/Solution | Market Segment | 2024 Performance Highlight | Growth Trajectory |

|---|---|---|---|

| Chromium Single Cell Platform Consumables | Single-Cell Analysis | Robust, consistent revenue from installed base | High Growth |

| Visium Spatial Gene Expression (incl. Visium HD) | Spatial Biology | Significant revenue driver, double-digit growth projected | High Growth |

| Xenium In Situ Analysis | Spatial Biology | Increasing adoption, driven by cost optimization | High Growth |

| Multiomic Solutions (Future) | Integrated Omics | Strategic investment for deeper biological insights | Projected High Growth |

What is included in the product

This BCG Matrix overview provides tailored analysis for 10X Genomics' product portfolio, highlighting which units to invest in, hold, or divest.

Visualize your portfolio's potential and challenges with a clear, quadrant-based BCG Matrix.

Streamline strategic decisions by quickly identifying growth opportunities and areas needing attention.

Cash Cows

Chromium Single Cell Instruments, despite a slowdown in new unit sales, represent a strong Cash Cow for 10X Genomics. The substantial installed base, exceeding 5,800 instruments worldwide as of early 2024, ensures robust and predictable revenue streams through the ongoing purchase of essential consumables. This mature segment of the single-cell analysis market provides a reliable foundation of recurring income.

Existing software solutions from 10x Genomics are designed to analyze data from their various platforms, making them crucial for customers. These tools likely contribute to a steady, predictable income stream through licensing or subscription models, serving a loyal customer base. The ongoing investment needed for their upkeep and enhancements is probably manageable, solidifying their position as a cash cow.

The older generation Visium instruments from 10X Genomics, predating the newer HD version, represent a classic cash cow. These instruments have cultivated a loyal and established user base, ensuring a consistent demand for their associated consumables.

While their growth trajectory might be slower compared to cutting-edge offerings, these instruments continue to generate a predictable and profitable revenue stream. This stability is a hallmark of cash cows, providing a reliable financial foundation.

For instance, in 2023, 10X Genomics reported that their Visium platform, which includes these older generation instruments, continued to be a significant revenue driver, contributing substantially to their overall sales figures and demonstrating the enduring value of this product line.

Intellectual Property and Patents

10x Genomics possesses a robust collection of intellectual property and patents specifically focused on single-cell and spatial biology technologies. This extensive patent portfolio acts as a significant competitive advantage, creating a strong moat around its core business. These patents are not just defensive; they represent a potential avenue for generating substantial revenue through licensing agreements and royalty payments.

The value of this intellectual property is underscored by recent financial events. For instance, a patent litigation settlement contributed to 10x Genomics' revenue in the first quarter of 2025, demonstrating the tangible financial benefits derived from its IP assets. This highlights how the company can monetize its innovations.

- Intellectual Property as a Competitive Moat: 10x Genomics' patents in single-cell and spatial biology protect its innovative technologies from competitors.

- Revenue Generation through Licensing: The company can earn income by licensing its patented technologies to other entities.

- Patent Litigation Settlement Impact: A Q1 2025 revenue contribution from a patent litigation settlement exemplifies the financial upside of IP.

- Low Investment, High Return Potential: The intellectual property itself requires minimal ongoing investment but offers the potential for high returns through various monetization strategies.

Core Consumables for Established Workflows

Beyond their innovative instruments, 10X Genomics relies heavily on the sale of essential consumables for its established single-cell and spatial genomics platforms. These reagents and kits are the lifeblood of routine experiments, forming a predictable and high-margin revenue stream. For instance, in 2023, consumables represented a significant portion of 10X Genomics' total revenue, underscoring their role as a core cash cow.

These fundamental supplies are critical for researchers to conduct ongoing experiments, creating a steady demand that is less susceptible to the boom-and-bust cycles of new product introductions. This consistent need ensures a stable financial foundation for the company.

- Core Consumables: Reagents and kits for single-cell RNA-seq, ATAC-seq, and spatial transcriptomics.

- High Margin: Consumables typically carry higher profit margins than instrumentation.

- Recurring Revenue: Essential for ongoing research, driving repeat purchases.

- 2023 Performance: Consumables were a key driver of 10X Genomics' revenue growth in 2023, contributing to their overall financial strength.

The established Chromium Single Cell instruments, with over 5,800 installed globally by early 2024, are a prime cash cow for 10X Genomics. Their robust installed base ensures consistent revenue from consumables, a mature market segment providing predictable income.

Existing software solutions are integral to data analysis for 10X Genomics' platforms, generating steady revenue through licensing or subscriptions. This loyal customer base and manageable upkeep costs solidify their cash cow status.

Older generation Visium instruments, while not as cutting-edge as newer models, maintain a loyal user base, driving consistent demand for associated consumables. Their slower growth is offset by predictable and profitable revenue streams, a hallmark of cash cows.

In 2023, the Visium platform, including these older instruments, remained a substantial revenue contributor for 10X Genomics, validating their enduring value.

10X Genomics' extensive patent portfolio in single-cell and spatial biology creates a strong competitive moat. These patents are a significant revenue source through licensing and royalties, as evidenced by a Q1 2025 patent litigation settlement contributing to revenue.

Consumables for 10X Genomics' single-cell and spatial genomics platforms represent a significant cash cow, providing a predictable, high-margin revenue stream. In 2023, consumables were a key revenue driver, essential for ongoing research and ensuring stable financial performance.

| Product Segment | BCG Matrix Category | Key Revenue Driver | Estimated Installed Base (Early 2024) | 2023 Revenue Contribution Indicator |

| Chromium Single Cell Instruments | Cash Cow | Consumables | > 5,800 | Significant |

| Existing Software Solutions | Cash Cow | Licensing/Subscriptions | N/A (Software dependent on instrument base) | Steady & Predictable |

| Older Generation Visium Instruments | Cash Cow | Consumables | N/A (Part of Visium platform) | Substantial |

| Intellectual Property (Patents) | Cash Cow | Licensing, Royalties, Litigation Settlements | N/A (Intangible Asset) | Tangible Benefits (e.g., Q1 2025 settlement) |

| Core Consumables (Reagents & Kits) | Cash Cow | Repeat Purchases for Experiments | N/A (Consumed by instruments) | Key Driver of Growth |

Delivered as Shown

10X Genomics BCG Matrix

The 10X Genomics BCG Matrix preview you are viewing is the identical, fully finalized document you will receive immediately after your purchase. This means you're seeing the complete, professionally formatted report, devoid of any watermarks or placeholder content, ready for your strategic application. You can be confident that the insights and analysis presented are precisely what you'll be working with, allowing for immediate integration into your business planning and decision-making processes.

Dogs

Older or discontinued instrument models, such as early iterations of 10X Genomics' single-cell sequencing platforms, would likely be classified as Dogs in a BCG matrix. These instruments, replaced by newer, more advanced technologies, typically exhibit a low market share in a mature or declining market segment.

For instance, if an older Chromium Controller model has been superseded by the Chromium X or iX systems, its market presence would diminish significantly. The company would still need to allocate resources for ongoing support and maintenance of these legacy systems, but the return on investment would be minimal compared to newer, high-demand products.

Certain highly specialized applications of 10x Genomics' technology, while promising, may fall into the niche, low-adoption category. These could include very specific research areas or experimental workflows that haven't yet achieved widespread market penetration.

If these niche applications have not yet gained significant traction, they would represent a low market share within a potentially low-growth segment. This could mean they are consuming resources without generating substantial revenue, a characteristic of a Dog in the BCG matrix.

Certain geographical regions represent underperforming markets for 10x Genomics. These areas are characterized by low market share and limited growth potential, possibly due to factors like reduced life science research funding or intense local competition. For instance, while 10x Genomics has seen strong adoption in North America and Europe, penetration in some emerging markets in Southeast Asia or parts of South America may be lagging, requiring careful strategic evaluation.

High-Cost, Low-Throughput Legacy Workflows

High-Cost, Low-Throughput Legacy Workflows are those older, more labor-intensive processes that newer, more efficient technologies have surpassed. Think of them as the clunky, outdated machines in a factory that are slow and expensive to run compared to the sleek, automated ones. These workflows often struggle to gain traction because their operational expenses are high, and they simply can't process samples or data quickly enough. Consequently, they generate very little revenue for a company.

In the context of a company like 10x Genomics, these legacy workflows would represent older product lines or service offerings that are no longer competitive. Their high cost per sample and slow turnaround times make them unattractive to researchers and labs looking for speed and affordability. This leads to low adoption rates, meaning fewer customers are using them, which in turn translates to minimal financial contribution.

Consider the situation where a company has invested heavily in developing a new, highly automated sequencing platform. If they still offer an older, manual sequencing service, that manual service would likely fall into this category. By 2024, the life sciences industry has seen a significant push towards automation and cost reduction, making these legacy options even less viable. For instance, while specific revenue figures for such categories are often proprietary, the trend is clear: companies are divesting or phasing out high-cost, low-throughput offerings to focus on more scalable and profitable solutions.

- Low Adoption: Limited uptake due to prohibitive costs and slow processing speeds.

- Minimal Revenue Generation: Contribute insignificantly to overall company income.

- Technological Obsolescence: Outperformed by newer, more efficient alternatives.

- High Operational Costs: Require more labor or resources per unit of output.

Certain Less Competitive Service Offerings

Certain less competitive service offerings within 10x Genomics' portfolio could be categorized as Dogs in a BCG Matrix analysis. These are services that likely exhibit low market share and low growth potential, meaning they aren't attracting many new customers and aren't expanding their footprint significantly. For example, if 10x Genomics offers a niche bioinformatics analysis service that is easily replicated by many other providers, it might fall into this category.

Such offerings might consume valuable resources, including specialized personnel and computational infrastructure, without generating substantial revenue or profit. This can divert attention and investment away from more promising areas of the business. Identifying these "Dog" services is crucial for strategic resource allocation.

- Low Market Share: Services with a minimal percentage of the total addressable market.

- Low Growth Potential: Services in markets that are not expanding or are stagnant.

- Resource Drain: Offerings that require significant investment but yield minimal returns.

- Strategic Review: These services often warrant a review for potential divestment or significant overhaul.

Dogs in the 10x Genomics BCG Matrix represent products or services with low market share in a mature or declining market. These often include older instrument models or legacy workflows that have been surpassed by newer, more efficient technologies. By 2024, the emphasis on automation and cost-effectiveness in life sciences makes these offerings less competitive, leading to minimal revenue generation and potentially high operational costs per unit. Identifying and strategically managing these "Dogs" is crucial for optimizing resource allocation.

Question Marks

Chromium Flex Technology, a key component in 10X Genomics' portfolio, is currently positioned as a Question Mark within the BCG Matrix. This technology is engineered for large-scale single-cell analysis, promising enhanced efficiency and user-friendliness, notably through its plate-based workflows.

The primary objective of Chromium Flex is to boost sample throughput and reduce the cost per sample, making advanced single-cell genomics more accessible. However, its market penetration and the extent to which it can truly revolutionize experimental volumes are still under active assessment by the company and the scientific community.

The Xenium RNA+Protein Multiomics capability from 10x Genomics represents a significant technological advancement, allowing for the simultaneous detection of RNA and proteins on a single slide. This innovative approach holds considerable promise for unlocking deeper biological insights, positioning it as a Question Mark within the BCG matrix.

While the potential for high growth is evident due to its ability to provide a more comprehensive understanding of cellular states, its current market penetration and the extent of widespread adoption are still developing. This means that while the future looks bright, the immediate market share and revenue generation are not yet established.

Xenium's new standalone protein analysis offerings represent a strategic move into a high-growth area within spatial biology. These innovations, while promising significant future returns, are currently in their nascent stages, reflecting a low market share due to their novelty and the substantial investment needed for widespread adoption and user education.

Expansion into Biopharma End-Market

10x Genomics is strategically targeting an expansion into the biopharma end-market, aiming to significantly increase its sales contribution from the current 15-20% to around 50%. This ambitious move positions biopharma as a Question Mark within the BCG framework. The company recognizes the substantial growth potential in this segment, which necessitates considerable investment in sales and marketing infrastructure to capture market share.

The biopharma sector represents a high-growth opportunity for 10x Genomics, driven by the increasing demand for advanced genomic technologies in drug discovery and development. For instance, in 2023, the global biopharmaceutical market was valued at approximately $1.7 trillion, with significant ongoing investments in R&D. Capturing even a fraction of this market requires a dedicated and robust commercial strategy.

- Targeted Growth: Increasing biopharma sales from 15-20% to ~50% signifies a major strategic shift.

- High Potential Market: The biopharma sector offers substantial growth prospects for genomic solutions.

- Investment Requirement: Achieving significant market penetration necessitates considerable expenditure on sales and marketing efforts.

- Strategic Pivot: This expansion is a key initiative for future revenue diversification and growth.

Early-Stage R&D Innovations

Early-stage R&D innovations represent 10x Genomics' potential future growth drivers. These are products still in development, not yet available for purchase, targeting emerging needs in biological research. For instance, advancements in spatial transcriptomics or single-cell multi-omics are prime examples of areas where 10x Genomics is investing heavily.

These nascent innovations are positioned in markets with significant future potential, as the demand for deeper biological insights continues to grow. However, they currently hold no market share. This necessitates substantial capital expenditure for research, development, and eventual commercialization, with the ultimate success and return on investment remaining uncertain.

- Future Biological Research Needs: Targeting areas like advanced spatial analysis and novel multi-omic integration.

- No Current Market Share: These are unproven technologies in the commercial sense.

- High Investment Required: Significant R&D funding is allocated to bring these to market.

- Uncertain Returns: The success and market adoption of these early-stage innovations are yet to be determined.

Question Marks in 10x Genomics' BCG Matrix represent products or strategies with high growth potential but low current market share. These are often new technologies or market entries requiring significant investment to gain traction. Their future success is uncertain, making them critical areas for strategic evaluation and resource allocation.

Chromium Flex Technology and Xenium RNA+Protein Multiomics are prime examples, aiming to revolutionize single-cell analysis and spatial biology, respectively. The company's aggressive push into the biopharma sector, currently comprising 15-20% of sales but targeted for 50%, also falls into this category. Early-stage R&D innovations, though not yet commercialized, also fit the Question Mark profile by targeting future market needs.

The success of these Question Marks hinges on effective market penetration, user adoption, and overcoming the substantial R&D and commercialization costs. For instance, the global biopharmaceutical market's significant R&D investment in 2023, valued at approximately $1.7 trillion, highlights the opportunity, but also the competitive landscape 10x Genomics faces.

These initiatives are crucial for 10x Genomics’ long-term growth and diversification, but they demand careful management of resources and a clear understanding of market dynamics to transition them into Stars or Cash Cows.

| Category | Current Market Share | Market Growth Rate | Strategic Focus | Potential Outcome |

| Chromium Flex Technology | Low | High | Increase adoption, reduce cost per sample | Star or Dog |

| Xenium RNA+Protein Multiomics | Low | High | Expand capabilities, drive user education | Star or Dog |

| Biopharma Market Expansion | Low (15-20%) | High | Significant sales & marketing investment | Star or Dog |

| Early-Stage R&D Innovations | None | Very High | Continued R&D investment, future commercialization | Potential Star or significant R&D write-off |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.